Marty is a sales consultant. Marty incurs the following expenses related to the entertainment of his clients

Question:

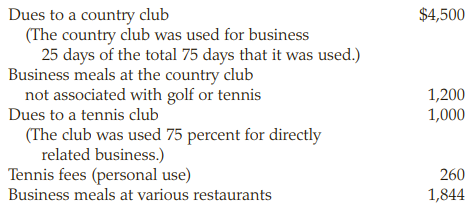

Marty is a sales consultant. Marty incurs the following expenses related to the entertainment of his clients in 2018:

a. How much is Marty’s deduction for entertainment expenses for 2018? $ __________

b. For each item listed above that you believe is not allowed as a deduction, explain the reason it is not allowed.

Transcribed Image Text:

Dues to a country club (The country club was used for business 25 days of the total 75 days that it was used.) Business meals at the country club not associated with golf or tennis Dues to a tennis club $4,500 1,200 1,000 (The club was used 75 percent for directly related business.) Tennis fees (personal use) 260 Business meals at various restaurants 1,844

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (14 reviews)

a Business meals at the country club 1200 Business meals at various resta...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

During the year, Brenda has the following expenses related to her employment. Airfare ............................................................................... $8,500 Meals...

-

A&J Co. incurred the following expenses related to patented drugs. 1. Indicate costs that are reported as research and development expenses on the income statement. 2. Indicate costs that are...

-

Can Joe Corporation deduct the following expenses related to its business? a. Legal fee paid ($40,000) to acquire a competing chain of stores b. Legal fee paid ($12,000) to determine whether it...

-

Amie, Inc., has 100,000 shares of $2 par value stock outstanding. Prairie Corporation acquired 30,000 of Amie's shares on January 1, 2015, for $120,000 when Amie's net assets had a total fair value...

-

Using the transactions in CP5-1, complete the following table by indicating the sign of the effect (+ for increase, - for decrease, NE for no effect, and CD for cannot determine) of each transaction....

-

Show that each sequence is geometric. Then find the common ratio and write out the first four terms. {()} 5 {bn}

-

1. Describe the training cycle.

-

1. Is it unfair to exempt employees to deprive them of overtime wages? Why or why not? 2. J&J argued that Smith was exempt under either the administrative employee exemption or the outside...

-

Plz I need Detailed and clearly, Organizer answere Ch-2- Assignment 1-from ch.2-E 2-4 The following transactions occurred during March 2013 for the Sur Corporation. The company owns and operates a...

-

A random sample of final examination grades for a college course follows. Use = .05 and test to determine whether a normal distribution should be rejected as being representative of the population's...

-

Which of the following taxpayers may not deduct their educational expense? a. A CPA who attends a course to review for the real estate agents exam. b. An independent sales representative who attends...

-

Which of the following is not likely to be a deductible expense? a. The cost of tickets to a stage play for a client and the taxpayer. b. The cost for Rosa to take a potential customer to lunch to...

-

The choice of \(\cot (\theta / 2)\) for the chordwise variation of the pressure coefficient gives the \(1 / \varepsilon^{1 / 2}\) type singularity at the leading edge and \(\varepsilon^{1 / 2}\) type...

-

Link two articles from a trade journal in your field and discuss them in a short paper...

-

Evaluate vendors for supplying differentiated or specialized widgets. Review the "Supplier Scorecard Data" document and answer the questions below. 1. Discuss which supplier you will select,...

-

3. By keeping the leading term in the relativistic correction, the kinetic energy operator T of a relativistic electron in one dimension can be written as p 3p4 + 2m 8m3c2 where c is the speed of...

-

CHOOSE CORRECT OPTION How might inadequate training impact Thandiwe's ability to address classroom challenges? a. Develops effective teaching strategies b. Enhances problem solving skills and creates...

-

A 3.5-kg cannon on wheels is loaded with a 0.0527-kg ball. The cannon and ball are initially moving forward with a speed of 1.27 m/s. The cannon is ignited and launches a 0.0527-kg ball forward with...

-

What magnetic field would be required in order to use an EPR Xband spectrometer (9 GHz) to observe 1 H-NMR and a 300 MHz spectrometer to observe EPR?

-

Write a paper about how diet relates to breast cancer in women study design to use: case control study purpose & rationale the purpose of this final project is to utilize the methods and...

-

Charlies Green Lawn Care is a cash basis taxpayer. Charlie Adame, the sole proprietor, is considering delaying some of his December 2018 customer billings for lawn care into the next year. In...

-

The Au Natural Clothing Corporation has changed its year-end from a calendar yearend to March 31, with permission from the IRS. The income for its short period from January 1 to March 31 is $24,000....

-

Barbara donates a painting that she purchased three years ago for $8,000, to a university for display in the presidents office. The fair market value of the painting on the date of the gift is...

-

Current Portion of Long-Term Debt PepsiCo, Inc., reported the following information about its long-term debt in the notes to a recent financial statement (in millions): Long-term debt is composed of...

-

Show transcribed image text 31/12/2016 GHS'000 25,500 The following information relates to the draft financial statements of Samanpa Ltd. Summarised statement of financial position as at: 31/12/2017...

-

\ How do i solve this? Beginning raw materials inventory Ending raw materials inventory Direct labor Operating expenses Purchases of direct materials Beginning work in process inventory Ending work...

Study smarter with the SolutionInn App