On July 8, 2020, Holly purchased a residential apartment building. The cost basis assigned to the building

Question:

On July 8, 2020, Holly purchased a residential apartment building. The cost basis assigned to the building is $750,000. Holly also owns another residential apartment building that she purchased on November 15, 2020, with a cost basis of $410,000.

Transcribed Image Text:

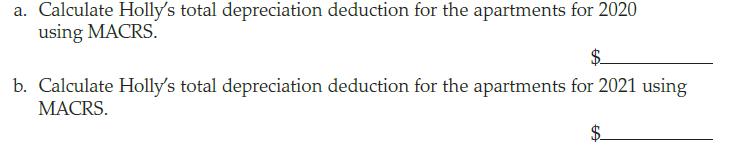

a. Calculate Holly's total depreciation deduction for the apartments for 2020 using MACRS. b. Calculate Holly's total depreciation deduction for the apartments for 2021 using MACRS. $

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (7 reviews)

a 14368 750000 ...View the full answer

Answered By

Carly Cimino

As a tutor, my focus is to help communicate and break down difficult concepts in a way that allows students greater accessibility and comprehension to their course material. I love helping others develop a sense of personal confidence and curiosity, and I'm looking forward to the chance to interact and work with you professionally and better your academic grades.

4.30+

12+ Reviews

21+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

On August 8, 2014, Holly purchased a residential apartment building. The cost basis assigned to the building is $800,000. Holly also owns another residential apartment building that she purchased on...

-

On May 8, 2016, Holly purchased a residential apartment building. The cost basis assigned to the building is $800,000. Holly also owns another residential apartment building that she purchased on...

-

Modified Accelerated Cost Recovery System (MACRS) (LO 8.2) On July 8, 2020, Holly purchased a residential apartment building. The cost basis assigned to the building is $750,000. Holly also owns...

-

4. Jerry intends to use the money from his loan (and his personal savings if necessary) to make an investment in his friend Elaines business. In return, Elaine has predicted the following returns on...

-

Is Moren liable to the partnership for her own negligence? Jax was a pizza restaurant in Foley, Minnesota, owned by two sisters: Nicole Moren and Amy Benedetti. They operated it as a partnership. One...

-

The chapter mentions five main topics that I/O psychologists investigate selection, training, organizational development, performance management and appraisal, and quality of work life. Which of...

-

Discuss Jaguar Land Rovers shift into other developing regions in Africa. What will be the implications of these on its sourcing and supply chain economies? LO.1

-

On October 1, Year 6, Versatile Company contracted to sell merchandise to a customer in Switzerland at a selling price of SF400,000. The contract called for the merchandise to be delivered to the...

-

CISC 3415 HW Assignment - 5 (4pts) 1. (2-pt) The picture in Figure 1 (which should be familiar from Project 5) is a plan of an area that you have to program a robot to navigate in. At different...

-

Belton Printing Company of Baltimore has applied for a loan. Its bank has requested a budgeted income statement for the month of April 2018 and a balance sheet at April 30, 2018. The March 31, 2018,...

-

On July 20, 2020, Kelli purchases office equipment at a cost of $24,000. Kelli elects out of bonus depreciation but makes the election to expense for 2020. She is selfemployed as an attorney, and, in...

-

James purchased office equipment for his business. The equipment has a depreciable basis of $14,000 and was put in service on June 1, 2020. James decides to elect straight-line depreciation under...

-

A stone is thrown straight upward with a speed of 20 m/s. It is caught on its way down at a point 5.0 m above where it was thrown. (a) How fast was it going when it was caught? (b) How long did the...

-

Your introduction needs to include the following. o Include a clear definition of unemployment and inflation and how and why they occur and rise in the economy. o Briefly provide your understanding...

-

Questions: 1. What strategies can be employed to foster a sense of inclusion and belonging within teams, and what are the potential benefits of doing so? 2. How can a team be successful? 3. What is...

-

Critical reflection involves closely examining events and experiences from different perspectives to inform future practice. In a few paragraphs, explain - Why educators should regularly reflect on...

-

What resources does the school or school district provide to teachers to promote diversity, equity, and inclusion? What are some of the strengths and shortcomings of the school's policies on...

-

Select FOUR companies listed on the UK Stock Exchange. Chose two companies from one industry sector and two other companies from another industry sector. By using the most recent three years'...

-

Why bring figures from today to the beginning of the retirement period?

-

Find the equations of the ellipses satisfying the given conditions. The center of each is at the origin. Passes through (2, 2) and (1, 4)

-

In 2016, Irene, an unmarried individual, pays $6,500 in qualified adoption expenses to an adoption agency for the final adoption of an eligible child who is not a child with special needs. In the...

-

If a taxpayer does not have enough tax liability to use all the available adoption credit, the unused portion may be carried forward for how many years? a. Two b. Three c. Five d. There is no...

-

Which of the following is not a tax preference or adjustment item for the individual alternative minimum tax computation? a. Miscellaneous itemized deductions b. State income taxes c. State income...

-

Create a Data Table to depict the future value when you vary the interest rate and the investment amount. Use the following assumptions: Interest Rates: Investment Amounts:-10.0% $10,000.00 -8.0%...

-

Isaac earns a base salary of $1250 per month and a graduated commission of 0.4% on the first $100,000 of sales, and 0.5% on sales over $100,000. Last month, Isaac's gross salary was $2025. What were...

-

Calculate the price, including both GST and PST, that an individual will pay for a car sold for $26,995.00 in Manitoba. (Assume GST = 5% and PST = 8%) a$29,154.60 b$30,234.40 c$30,504.35 d$28,334.75...

Study smarter with the SolutionInn App