Question:

Rob Wriggle operates a small plumbing supplies business as a sole proprietor. In 2020, the plumbing business has gross business income of $421,000 and business expenses of $267,000, including wages paid of $58,000. The business sold some land that had been held for investment generating a long-term capital gain of $15,000. The business has $300,000 of qualified business property in 2020. Rob’s wife, Marie, has wage income of $250,000. They jointly sold stocks in 2020 and generated a long-term capital gain of $13,000. Rob and Marie have no dependents and in 2020, they take the standard deduction of $24,800.

a. What is Rob and Marie’s taxable income before the QBI deduction?

b. What is Rob and Marie’s QBI?

c. What is Rob and Marie’s QBI deduction?

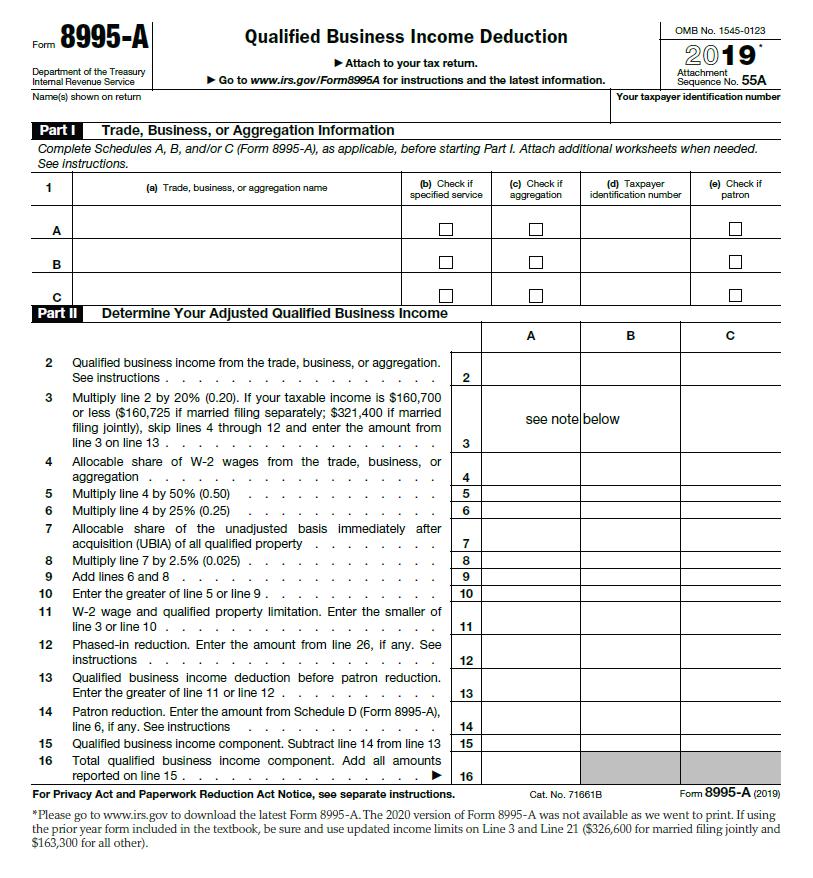

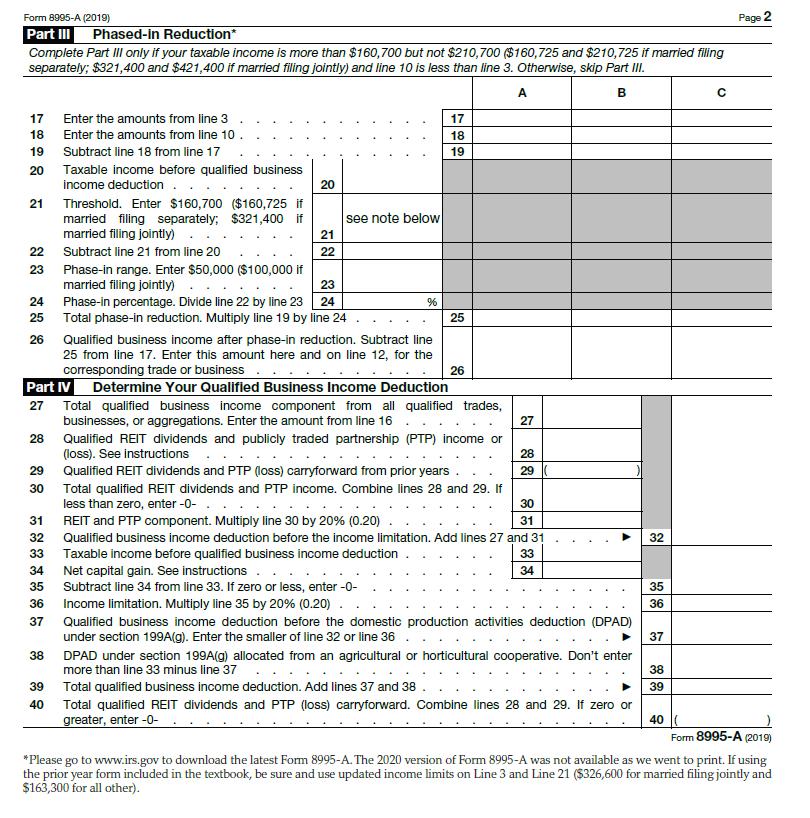

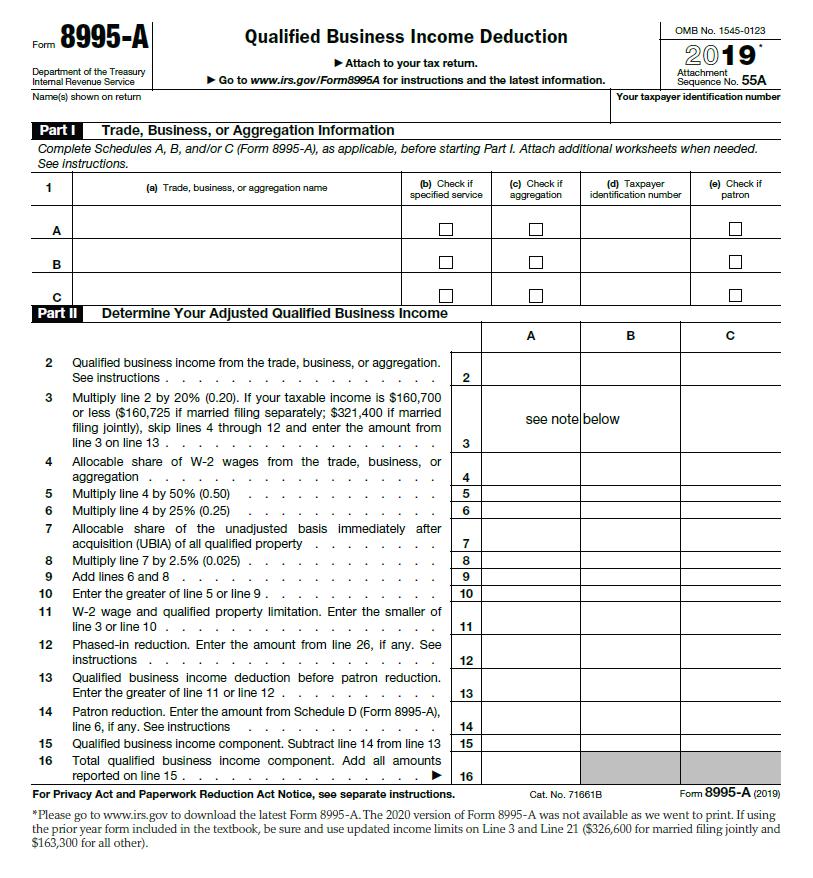

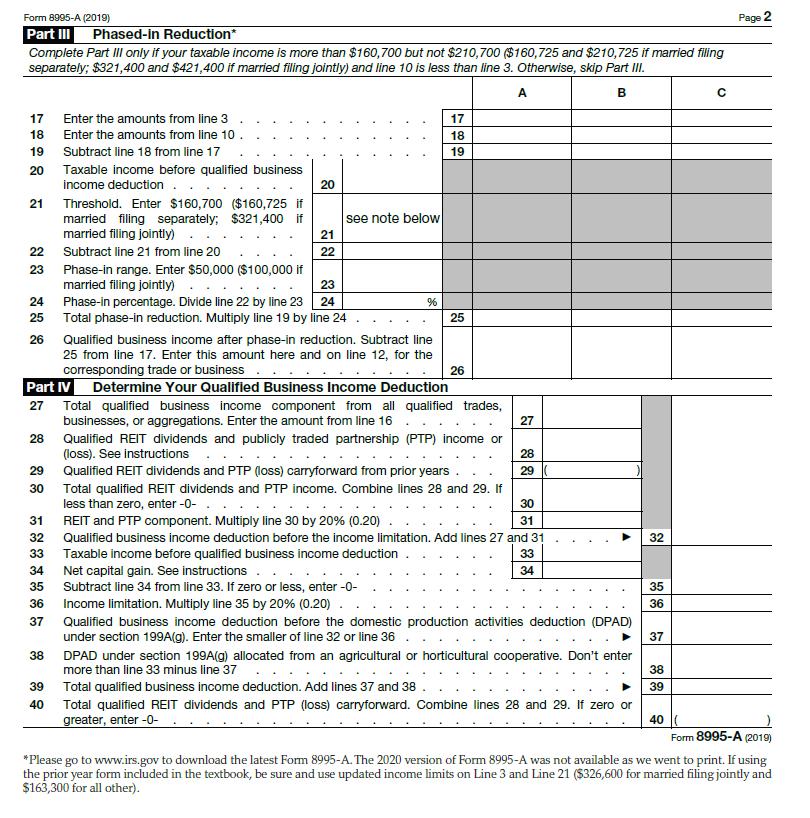

d. Complete Form 8995-A on Pages 4-61 and 4-62 to report Rob’s QBI deduction.

Transcribed Image Text:

Form 8995-A

Department of the Treasury

Internal Revenue Service

Name(s) shown on return

A

Part I Trade, Business, or Aggregation Information

Complete Schedules A, B, and/or C (Form 8995-A), as applicable, before starting Part I. Attach additional worksheets when needed.

See instructions.

1

B

2

3

Part II Determine Your Adjusted Qualified Business Income

4

567

8

9

10

11

12

13

Qualified Business Income Deduction

►Attach to your tax return.

Go to www.irs.gov/Form8995A for instructions and the latest information.

14

(a) Trade, business, or aggregation name

15

16

(b) Check if

specified service

Qualified business income from the trade, business, or aggregation.

See instructions.

Multiply line 2 by 20% (0.20). If your taxable income is $160,700

or less ($160,725 if married filing separately; $321,400 if married

filing jointly), skip lines 4 through 12 and enter the amount from

line 3 on line 13..

Allocable share of W-2 wages from the trade, business, or

aggregation.

Multiply line 4 by 50% (0.50)

Multiply line 4 by 25% (0.25)

Allocable share of the unadjusted basis immediately after

acquisition (UBIA) of all qualified property

Multiply line 7 by 2.5% (0.025).

Add lines 6 and 8 . . .

Enter the greater of line 5 or line 9.

W-2 wage and qualified property limitation. Enter the smaller of

line 3 or line 10.

Phased-in reduction. Enter the amount from line 26, if any. See

instructions.

Qualified business income deduction before patron reduction.

Enter the greater of line 11 or line 12..

Patron reduction. Enter the amount from Schedule D (Form 8995-A),

line 6, if any. See instructions...

2

3

4

5

6

789

10

11

12

13

14

15

(c) Check if

aggregation

16

OMB No. 1545-0123

2019

Attachment

Sequence No. 55A

Your taxpayer identification number

A

(d) Taxpayer

identification number

see note below

B

(e) Check if

patron

Qualified business income component. Subtract line 14 from line 13

Total qualified business income component. Add all amounts

reported on line 15. .

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 71661B

Form 8995-A (2019)

*Please go to www.irs.gov to download the latest Form 8995-A. The 2020 version of Form 8995-A was not available as we went to print. If using

the prior year form included in the textbook, be sure and use updated income limits on Line 3 and Line 21 ($326,600 for married filing jointly and

$163,300 for all other).

с