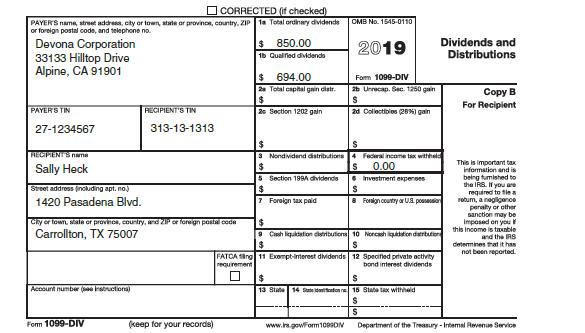

Sally and Charles Heck received the following Form 1099-DIV in 2019: The Hecks also received the following

Question:

Sally and Charles Heck received the following Form 1099-DIV in 2019:

The Hecks also received the following dividends and interest in 2019 (Forms 1099-DIV not shown):

Sally Charles Jointly Qualifying dividends:

Altus Inc. $2,000 Buller Corp. $350 Gene Corporation $3,100 Interest:

Porcine Bank 1,245 River Bank 650 City of New York Bonds 100 Assuming the Hecks file a joint tax return, complete Schedule B of Form 1040 (on Page 2-53) for them for the 2019 tax year. Do not attempt to complete the Qualified Dividends and Capital Gain Tax Worksheet.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Income Tax Fundamentals Whittenburg Gill 2020

ISBN: 9780357107065

1st Edition

Authors: Whittenburg/Altus Buller/Gill

Question Posted: