Walter, a single taxpayer, purchased a limited partnership interest in a tax shelter in 1994. He also

Question:

Walter, a single taxpayer, purchased a limited partnership interest in a tax shelter in 1994. He also acquired a rental house in 2020, which he actively manages. During 2020, Walter’s share of the partnership’s losses was $30,000, and his rental house generated $20,000 in losses. Walter’s modified adjusted gross income before passive losses is $130,000.

Transcribed Image Text:

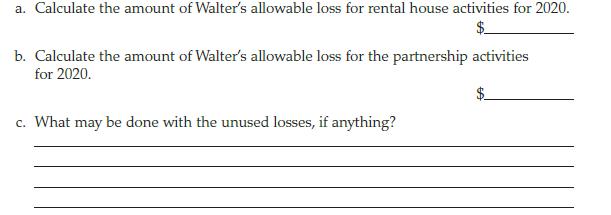

a. Calculate the amount of Walter's allowable loss for rental house activities for 2020. b. Calculate the amount of Walter's allowable loss for the partnership activities for 2020. c. What may be done with the unused losses, if anything?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

a 10000 25000 50 x 130000 100000 b 0 no loss is al...View the full answer

Answered By

ANDREW KIPRUTO

Academic Writing Expert

I have over 7 years of research and application experience. I am trained and licensed to provide expertise in IT information, computer sciences related topics and other units like chemistry, Business, law, biology, biochemistry, and genetics. I'm a network and IT admin with +8 years of experience in all kind of environments.

I can help you in the following areas:

Networking

- Ethernet, Wireless Airmax and 802.11, fiber networks on GPON/GEPON and WDM

- Protocols and IP Services: VLANs, LACP, ACLs, VPNs, OSPF, BGP, RADIUS, PPPoE, DNS, Proxies, SNMP

- Vendors: MikroTik, Ubiquiti, Cisco, Juniper, HP, Dell, DrayTek, SMC, Zyxel, Furukawa Electric, and many more

- Monitoring Systems: PRTG, Zabbix, Whatsup Gold, TheDude, RRDtoo

Always available for new projects! Contact me for any inquiries

4.30+

1+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Walter, a single taxpayer, purchased a limited partnership interest in a tax shelter in 1993. He also acquired a rental house in 2019, which he actively manages. During 2019, Walters share of the...

-

Which of the following is true about the rental of real estate? a. Depreciation and maintenance expenses for an apartment complex are deductible. b. A vacation home is a home that is rented for 15...

-

Walter, a single taxpayer, purchased a limited partnership interest in a tax shelter in 1985. He also acquired a rental house in 2015, which he actively manages. During 2015, Walter's share of the...

-

In Exercises 912, use the given conditions to write an equation for each line in point-slope form and general form Passing through (4, -7) and perpendicular to the line whose equation is x - 2y - 3 =...

-

Explain the relationship and differences between a module and a program.

-

What is "financial flexibility," and is it increased or decreased by a high debt ratio? AppendixLO1

-

Advance planning of an overseas business trip is, from one perspective, the most important stage of the visit. It allows the business person to acquire important information about the country to be...

-

Some international management experts contend that globalization and national responsiveness are diametrically opposed forces, and that to accommodate one, a multinational must relax its efforts in...

-

On January 1, 2020, Texas Company issued a 6% $100,000 bond for $90,000. The market rate for a bond of this type is 8%. The bond pays interest semi-annually on June 30 and December 31. The bond is a...

-

Prepare an Excel spreadsheet with a budget for Cupcakes-Palooza Inc. for 2023 using the assumptions below. Your assignment will be to produce a spreadsheet with the sales, expenses, and net income...

-

Jim, a single taxpayer, bought his home 20 years ago for $25,000. He has lived in the home continuously since he purchased it. In 2020, he sells his home for $300,000. What is Jims taxable gain on...

-

Susan, a single taxpayer, bought her home 25 years ago for $30,000. She has lived in the home continuously since she purchased it. In 2020, she sells her home for $200,000. What is Susans taxable...

-

A JIT/lean system uses kanban cards to authorize production and movement of materials. In one portion of the system, a work centre uses an average of 100 pieces of a part per hour. The manager has...

-

Identify at least two business systems that support the development of effective work relationships Briefly explain how each system supports the development of effective work relationships.

-

Power and Influence Personal Plan - How will you navigate the realms of power and influence? Why is this personal plan important for you? What do you want to achieve? do a table with SMART goals -...

-

A single-stage trickling-filter plant is proposed for treating a dilute wastewater with a BOD concentration of 170 mg/L. The plant is located in a warm climate, and the minimum wastewater temperature...

-

For the first assignment for this course, compose a written document that contains the following: A description and assessment of your past experiences with policy and program planning, either your...

-

What are the key motivators driving consumer purchasing decisions in our industry? How do consumers perceive our brand compared to competitors, and what factors influence brand loyalty?

-

The unadjusted trial balance and adjustment data for Nazari Electrical Services are presented in P4-6B. Instructions Prepare a work sheet for the year ended August 31, 2017. Taking It Further Explain...

-

Solve each equation or inequality. |6x8-4 = 0

-

Carol maintains an office in her home where she conducts a dressmaking business. During the year she collects $4,000 from sales, pays $1,300 for various materials and supplies, and properly allocates...

-

Cindy operates a computerized engineering drawing business from her home. Cindy maintains a home office and properly allocates the following expenses to her office:...

-

Cindy operates a computerized engineering drawing business from her home. Cindy maintains a home office and properly allocates the following expenses to her office:...

-

Ventaz Corp manufactures small windows for back yard sheds. Historically, its demand has ranged from 30 to 50 windows per day with an average of 4646. Alex is one of the production workers and he...

-

Which of the following statements is not true regarding the $500 credit for dependent other than a qualifying child credit. Cannot be claimed on the same tax return if the child tax credit is also...

-

Grind Co. is considering replacing an existing machine. The new machine is expected to reduce labor costs by $127,000 per year for 5 years. Depreciation on the new machine is $57,000 compared with...

Study smarter with the SolutionInn App