Xialu is a single taxpayer who is under age 65 and in good health. For 2020, she

Question:

Xialu is a single taxpayer who is under age 65 and in good health. For 2020, she has a salary of $25,000 and itemized deductions of $7,000. Leslie allows her mother to live with her during the winter months (3–4 months per year), but her mother provides all of her own support otherwise.

Transcribed Image Text:

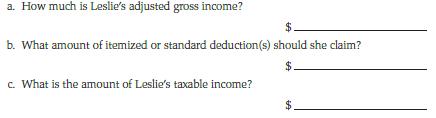

a. How much is Leslie's adjusted gross income? b. What amount of itemized or standard deduction (s) should she claim? c. What is the amount of Leslie's taxable income?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

a 25000 b 12400 the gr...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Leslie is a single taxpayer who is under age 65 and in good health. For 2018, she has a salary of $24,000 and itemized deductions of $1,000. Leslie allows her mother to live with her during the...

-

Leslie is a single taxpayer who is under age 65 and in good health. For 2019, she has a salary of $24,000 and itemized deductions of $1,000. Leslie allows her mother to live with her during the...

-

Leslie is a single taxpayer who is under age 65 and in good health. For 2014, she has a salary of $23,000 and itemized deductions of $1,000. Leslie is entitled to one exemption on her tax return. a....

-

Solve each system. If a system is inconsistent or has dependent equations, say so. -5x + 2y = -4 6x + 3y = -6

-

What are the four basic parts of a use case model? What is its purpose or objective?

-

What considerations other than costs are relevant to

-

Greeks on campus. The question-and-answer column of a campus newspaper was asked what percentage of the campus was Greek (that is, members of fraternities or sororities). The answer given was that...

-

A partial work sheet for Jim Jacobs' Furniture Repair is shown as follows. Indicate by letters (a) through (d) the four adjustments in the Adjustments columns of the work sheet, properly matching...

-

ores/4580/assignments modulo 11 F21 Assignments Homework for Section 3.2 Homework for Section 3.2 Due Thursday by 10pm Points 100 Submitting an external tool Homework for Section 3.2 Score: 60.06/100...

-

Beale Management has a noncontributory, defined benefit pension plan. On December 31, 2021 (the end of Beale's fiscal year), the following pension-related data were available ($ in millions) $520...

-

Typical corporate income is reported on: a. Form 1040 b. Form 1120 c. Form 1040X d. Form 1065

-

Jason and Mary Wells, friends of yours, were married on December 30, 2020. They know you are studying taxes and have sent you an e-mail with a question concerning their filing status. Jason and Mary...

-

Solve each equation. Give exact solutions. log (72x) = log 4

-

You have two dashboards in the same workspace named Production and Manufacturing. Your company's Power BI administrator creates the following two dashboard data classifications: Medium Impact (MEDI)...

-

Question 2: Red Rocks Corporation was organized on September 1. Red Rocks encountered the following events during the first month of operations. a. Received $65,000 cash from the investors who...

-

he previous three weeks of data is below for the sales of sheds at SHEDS INC. Calculate the forecast for the next perioud (week 4) using a two period weighted moving average using weights of 3 and 2....

-

/3 3) ST tan(x) - In(cosx) dx What is the value of u? us dulcis) What is the corresponding value of du? du= 1-5mx dx cosx You must show all of your work in the space below to earn full credit. 9/3 So...

-

Please use the file which provides the data to answer the problems 1-3. Problem 1) The time Students entered the classroom of OM 390, Introductory Operations Management, was recorded by the professor...

-

Demello & Associates records adjusting entries on an annual basis. The company has the following information available on accruals that must be recorded for the year ended December 31, 2017: 1....

-

Write a paper detailing a geographic information system (GIS) of your own design that would utilize data in an original manner.

-

In 2019, Gale and Cathy Alexander hosted an exchange student, Axel Muller, for 9 months. Axel was part of International Student Exchange Programs (a qualified organization). Axel attended tenth grade...

-

John Williams (birthdate August 2, 1976) is a single taxpayer. Johns earnings and withholdings as the manager of a local casino for 2019 are reported on his Form W-2: Johns other income includes...

-

Which of the following entities is likely to have the greatest flexibility in choosing a year-end other than a calendar year-end? a. Sole proprietor b. General partnership c. Corporation d. S...

-

Discuss American History

-

Your firm has developed a new lithium ion battery polymer that could enhance the performance of lithion ion batteries. These batteries have applications in many markets including cellphones, laptops,...

-

Need help analyzing statistical data 1. ANOVA) True or false: If we assume a 95% confidence level, there is a significant difference in performance generally across all groups. 2. (t-test) True or...

Study smarter with the SolutionInn App