Big John Oil Company, located in Southern California, has been operating for three years. Big John uses

Question:

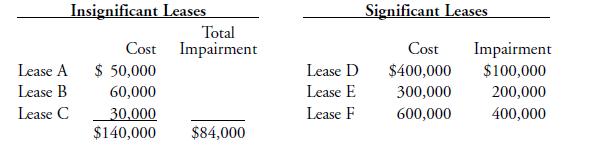

Big John Oil Company, located in Southern California, has been operating for three years. Big John uses full-cost accounting and excludes all possible costs from the amortization base. The following account balances are as of the end of 2010:

REQUIRED: Give any entries necessary for the following events and transactions.

a. Lease A was abandoned on March 20, 2011.

b. Lease B was proved on May 13.

c. Insignificant leases costing \($80,000\) were acquired during 2011.

d. Lease E was abandoned early in July.

e. Lease F was proved October 21.

f. At December 31, Big John decides that Lease D should be impaired an additional \($150,000.\)

g. At December 31, Big John decides to continue its policy of maintaining an allowance for impairment equal to 60% of unproved insignificant leases.

Step by Step Answer:

Fundamentals Of Oil And Gas Accounting

ISBN: 9780878147939

4th Edition

Authors: Rebecca A. Gallun, Ph.D. Wright, Charlotte J, Linda M. Nichols, John W. Stevenson