Universal Oil Company, an independent producer, began operations in June 20XA. During the first 21/2 years of

Question:

Universal Oil Company, an independent producer, began operations in June 20XA.

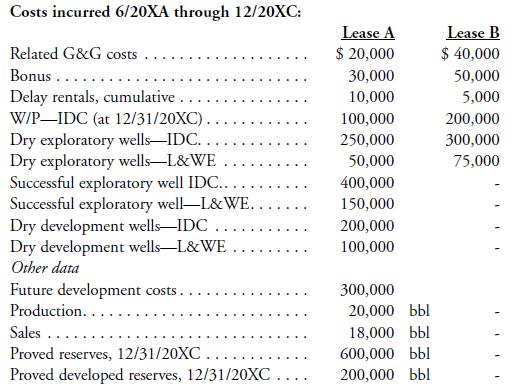

During the first 21/2 years of operation, Universal acquired only two U.S. properties, which were noncontiguous. Costs incurred on those properties during that 21/2 years are given below, net of accumulated DD&A. Universal drilled three dry holes and one successful well. No equipment was salvaged from the dry holes. Production on the successful well started on January 1, 20XB. During 20XC, Universal incurred total IDC of \($100,000\) on Lease A (in W/P-IDC at 12/31/20XC) and \($200,000\) on Lease B (in W/PIDC at 12/31/20XC). All 20XC IDC on both leases was incurred early in May. All reserve, production, and sales data below apply only to Universal Oil Company.

Universal also placed in service on 1/1/20XB a building that cost \($117,000\) and has a life of 25 years with a salvage value of \($7,000.\) The building houses the corporate headquarters that supports oil and gas operations in the United States and non oil and gas operations in Mexico. The operations conducted in the building are general in nature and are not directly attributable to any specific exploration, development, or production activity.

Since the building is not directly related to exploration, development, or production and supports activities in more than one cost center, it is depreciated using straight-line depreciation for financial accounting.

a. Compute DD&A for 20XC for the following accounting methods assuming that Universal is an independent producer:

1) SE

2) FC, assuming inclusion of all possible costs in the amortization base. Ignore the revenue method

3) Tax: ignore percentage depletion and assume that the cost of the equipment and the building are gross costs

b. Calculate DD&A for tax, assuming that Universal had been an integrated producer instead.

Step by Step Answer:

Fundamentals Of Oil And Gas Accounting

ISBN: 9780878147939

4th Edition

Authors: Rebecca A. Gallun, Ph.D. Wright, Charlotte J, Linda M. Nichols, John W. Stevenson