Accounting, Analysis, and Principles Electroboy Enterprises, Inc. operates several stores throughout northern Belgium and the southern part

Question:

Accounting, Analysis, and Principles Electroboy Enterprises, Inc. operates several stores throughout northern Belgium and the southern part of the Netherlands. As part of an operational and financial reporting review in a response to a downturn in it markets, the company’s management has decided to perform an impairment test on five stores (combined).

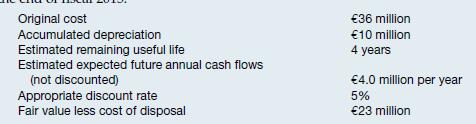

The five stores’ sales have declined due to aging facilities and competition from a rival that opened new stores in the same markets. Management has developed the following information concerning the five stores as of the end of fiscal 2015.

Accounting

(a) Determine the amount of impairment loss, if any, that Electroboy should report for fiscal 2015 and the carrying amount at which Electroboy should report the five stores on its fiscal year-end 2015 statement of financial position. Assume that the cash flows occur at the end of each year.

(b) Repeat part (a), but instead assume that (1) the estimated remaining useful life is 10 years, (2) the estimated annual cash flows are €2,720,000 per year, and (3) the appropriate discount rate is 6%.

Analysis Assume that you are a financial analyst and you participate in a conference call with Electroboy management in early 2016 (before Electroboy closes the books on fiscal 2015). During the conference call, you learn that management is considering selling the five stores, but the sale will not likely be completed until the second quarter of fiscal 2016. Briefly discuss what implications this would have for Electroboy’s 2015 financial statements. Assume the same facts as in part

(b) above.

Principles Electroboy management would like to know the accounting for the impaired asset in periods subsequent to the impairment.

(a) Suppose conditions improve in its markets. Can the assets be written back up? Briefly discuss the conceptual arguments for this accounting.

(b) Briefly describe how IFRS differs from U.S. GAAP with respect to accounting for impaired tangible, long-lived assets. Does U.S. accounting better align with the concept of neutrality? Explain.

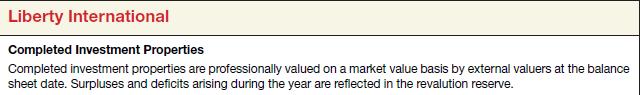

International Reporting Case Liberty International (GBR), a real estate company, follows IFRS. In a recent year, Liberty disclosed the following information on revaluations of its tangible fixed assets. The revaluation reserve measures the amount by which tangible fixed assets are recorded above historical cost and is reported in Liberty’s equity.

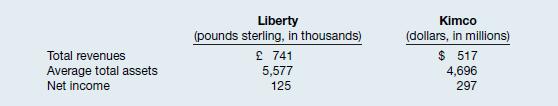

Liberty reported the following additional data. Amounts for Kimco Realty (USA) (which follows U.S.

GAAP) in the same year are provided for comparison.

Instructions

(a) Compute the following ratios for Liberty and Kimco.

(1) Return on assets.

(2) Profit margin.

(3) Asset turnover.

How do these companies compare on these performance measures?

(b) Liberty reports a revaluation surplus in Accumulated Other Comprehensive Income of £1,952. Assume that £1,550 of this amount arose from an increase in the net replacement value of investment properties during the year. Prepare the journal entry to record this increase.

(c) Under IFRS, are Liberty’s assets and equity overstated? If so, why? When comparing Liberty to U.S.

companies, like Kimco, what adjustments would you need to make in order to have valid comparisons of ratios such as those computed in

(a) above?

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield