Below are transactions related to Impala Company. (a) The City of Pebble Beach gives the company 5

Question:

Below are transactions related to Impala Company.

(a) The City of Pebble Beach gives the company 5 acres of land as a plant site. The fair value of this land is determined to be \($81\),000.

(b) 14,000 ordinary shares with a par value of \($50\) per share are issued in exchange for land and buildings.

The property has been appraised at a fair value of \($810\),000, of which \($180\),000 has been allocated to land and \($630\),000 to buildings. The shares of Impala Company are not listed on any exchange, but a block of 100 shares was sold by a shareholder 12 months ago at \($65\) per share, and a block of 200 shares was sold by another shareholder 18 months ago at \($58\) per share.

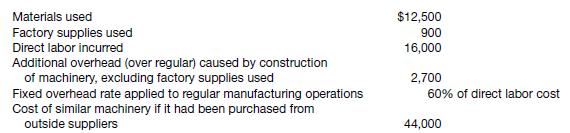

(c) No entry has been made to remove from the accounts for Materials, Direct Labor, and Overhead the amounts properly chargeable to plant asset accounts for machinery constructed during the year. The following information is given relative to costs of the machinery constructed.

Instructions Prepare journal entries on the books of Impala Company to record these transactions.

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield