Financial Statement Analysis Cases Case 1 Lumber Supply International Lumber Supply International is a manufacturer of specialty

Question:

Financial Statement Analysis Cases Case 1 Lumber Supply International Lumber Supply International is a manufacturer of specialty building products. The company, through its partnership in the Trus Joist MacMillan joint venture, develops and manufactures engineered lumber. This product is a high-quality substitute for structural lumber, and uses lower-grade wood and materials formerly considered waste. The company also is majority owner of the Outlook Window Partnership, which is a consortium of three wood and vinyl window manufacturers.

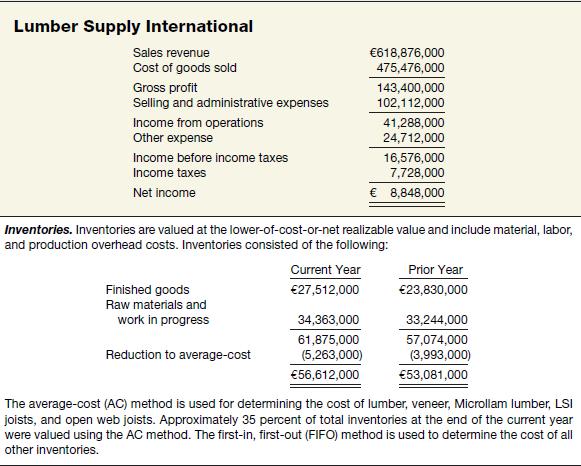

Following is Lumber Supply International’s adapted income statement and information concerning inventories from its statement of financial position.

Instructions

(a) How much would income before taxes have been if FIFO costing had been used to value all inventories?

(b) If the income tax rate is 46.6%, what would income tax have been if FIFO costing had been used to value all inventories? In your opinion, is this difference in net income between the two methods material? Explain.

(c) Does the use of a different costing system for different types of inventory mean that there is a different physical flow of goods among the different types of inventory? Explain.

Case 2 Noven Pharmaceuticals, Inc.

Noven Pharmaceuticals, Inc. (USA), headquartered in Miami, Florida, describes itself in a recent annual report as follows.

Noven also reported in its annual report that its activities to date have consisted of product development efforts, some of which have been independent and some of which have been completed in conjunction with Rhone-Poulenc Rorer (RPR) (FRA) and Ciba-Geigy (USA). The revenues so far have consisted of money received from licensing fees, “milestone” payments (payments made under licensing agreements when certain stages of the development of a certain product have been completed), and interest on its investments. The company expects that it will have significant revenue in the upcoming fiscal year from the launch of its first product, a transdermal estrogen delivery system.

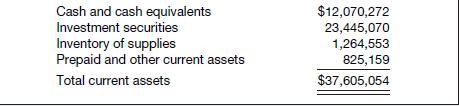

The current assets portion of Noven’s statement of financial position follows.

Inventory of supplies is recorded at the lower-of-cost (first-in, first-out)-or-net realizable value and consists mainly of supplies for research and development.

Instructions

(a) What would you expect the physical flow of goods for a pharmaceutical manufacturer to be most like, FIFO or random (flow of goods does not follow a set pattern)? Explain.

(b) What are some of the factors that Noven should consider as it selects an inventory measurement method?

(c) Suppose that Noven had $49,000 in an inventory of transdermal estrogen delivery patches. These patches are from an initial production run, and will be sold during the coming year. Why do you think that this amount is not shown in a separate inventory account? In which of the accounts shown is the inventory likely to be? At what point will the inventory be transferred to a separate inventory account?

Case 3 SUPERSTORE SUPERSTORE reported that its inventory turnover decreased from 17.1 times in 2015 to 15.8 times in 2016.

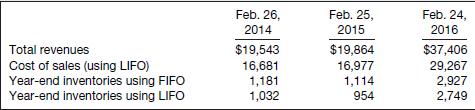

The following data appear in SUPERSTORE’s annual report.

a) Compute SUPERSTORE’s inventory turnovers (see Appendix 5A for the inventory turnover formula) for 2015 and 2016 using:

(1) Cost of sales and LIFO inventory.

(2) Cost of sales and FIFO inventory.

(b) Some firms calculate inventory turnover using sales rather than cost of goods sold in the numerator.

Calculate SUPERSTORE’s 2015 and 2016 turnover using:

(1) Sales and LIFO inventory.

(2) Sales and FIFO inventory.

(c) Describe the method that SUPERSTORE appears to use.

(d) State which method you would choose to evaluate SUPERSTORE’s performance. Justify your choice.

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield