From inception of operations to December 31, 2015, Fortner Corporation provided for uncollectible accounts receivable under the

Question:

From inception of operations to December 31, 2015, Fortner Corporation provided for uncollectible accounts receivable under the allowance method: provisions were made monthly at 2% of credit sales; bad debts written off were charged to the allowance account; recoveries of bad debts previously written off were credited to the allowance account; and no year-end adjustments to the allowance account were made. Fortner’s usual credit terms are net 30 days.

The balance in Allowance for Doubtful Accounts was £130,000 at January 1, 2015. During 2015, credit sales totaled £9,000,000, interim provisions for doubtful accounts were made at 2% of credit sales, £90,000 of bad debts were written off, and recoveries of accounts previously written off amounted to £15,000.

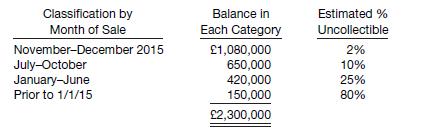

Fortner installed a computer system in November 2015, and an aging of accounts receivable was prepared for the first time as of December 31, 2015. A summary of the aging is as follows.

Based on the review of collectibility of the account balances in the “prior to 1/1/15” aging category, additional receivables totaling £60,000 were written off as of December 31, 2015. The 80% uncollectible estimate applies to the remaining £90,000 in the category. Effective with the year ended December 31, 2015, Fortner adopted a different method for estimating the allowance for doubtful accounts at the amount indicated by the year-end aging analysis of accounts receivable.

Instructions

(a) Prepare a schedule analyzing the changes in Allowance for Doubtful Accounts for the year ended December 31, 2015. Show supporting computations in good form. (Hint: In computing the 12/31/15 allowance, subtract the £60,000 write-off.)

(b) Prepare the journal entry for the year-end adjustment to the Allowance for Doubtful Accounts balance as of December 31, 2015.

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield