Hiatt Toothpaste Company initiates a defined benefit pension plan for its 50 employees on January 1, 2015.

Question:

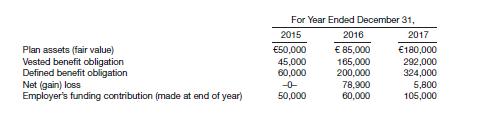

Hiatt Toothpaste Company initiates a defined benefit pension plan for its 50 employees on January 1, 2015. The insurance company which administers the pension plan provided the following selected information for the years 2015, 2016, and 2017.

There were no balances as of January 1, 2015, when the plan was initiated. The actual return on plan assets was 10% over the 3-year period, but the discount (interest) rate was 13% in 2015, 11% in 2016, and 8% in 2017. The service cost component of net periodic pension expense amounted to the following: 2015, €60,000;

2016, €85,000; and 2017, €119,000. No benefits were paid in 2015, €30,000 of benefits were paid in 2016, and €18,500 of benefits were paid in 2017 (all benefits paid at end of year).

Instructions (Round to the nearest euro.)

(a) Calculate the amount of net periodic pension expense that the company would recognize in 2015, 2016, and 2017.

(b) Prepare the journal entries to record net periodic pension expense, employer’s funding contribution, and related pension amounts for the years 2015, 2016, and 2017.

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield