Presented below are income statements prepared on an average-cost and FIFO basis for Carlton SA, which started

Question:

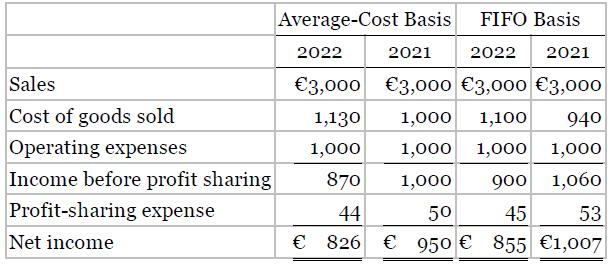

Presented below are income statements prepared on an average-cost and FIFO basis for Carlton SA, which started operations on January 1, 2021. The company presently uses the average-cost method of pricing its inventory and has decided to switch to the FIFO method in 2022. The FIFO income statement is computed in accordance with IFRS. Carlton’s profit-sharing agreement with its employees indicates that the company will pay employees 5% of income before profit sharing. Income taxes are ignored.

Instructions

Answer the following questions.

a. If comparative income statements are prepared, what net income should Carlton report in 2021 and 2022?

b. Explain why, under the FIFO basis, Carlton reports €50 in 2021 and €48 in 2022 for its profit-sharing expense.

c. Assume that Carlton has a beginning balance of retained earnings of €8,000 at January 1, 2022, using the average-cost method. The company declared and paid dividends of €2,500 in 2022. Prepare the retained earnings statement for 2022, assuming that Carlton has switched to the FIFO method.

Step by Step Answer:

Intermediate Accounting IFRS

ISBN: 9781119607519

4th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield