Presented below is the trial balance of Vivaldi Corporation at December 31, 2015. Instructions Prepare a statement

Question:

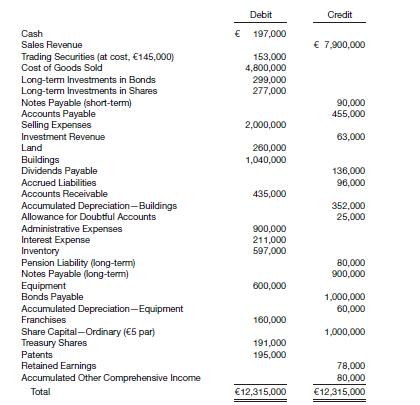

Presented below is the trial balance of Vivaldi Corporation at December 31, 2015.

Instructions Prepare a statement of financial position at December 31, 2015, for Vivaldi Corporation. (Ignore income taxes.)

Transcribed Image Text:

Cash Sales Revenue Trading Securities (at cost, 145,000) Cost of Goods Sold Debit 197,000 153,000 4,800,000 Credit 7,900,000 Long-term Investments in Bonds Long-term Investments in Shares Notes Payable (short-term) Accounts Payable Selling Expenses Investment Revenue 299,000 277,000 90,000 455,000 2,000,000 63,000 Land Buildings Dividends Payable 260,000 1,040,000 136,000 Accrued Liabilities 96,000 Accounts Receivable 435,000 Accumulated Depreciation-Buildings 352,000 Allowance for Doubtful Accounts 25,000 Administrative Expenses 900,000 Interest Expense 211,000 Inventory 597,000 Pension Liability (long-term) 80,000 Notes Payable (long-term) Equipment Bonds Payable Accumulated Depreciation-Equipment Franchises Share Capital-Ordinary (5 par) 900,000 600,000 1,000,000 60,000 160,000 1,000,000 Treasury Shares 191,000 Patents 195,000 Retained Earnings 78,000 Accumulated Other Comprehensive Income 80,000 Total 12,315,000 12,315,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (1 review)

Answered By

GERALD KAMAU

non-plagiarism work, timely work and A++ work

4.40+

6+ Reviews

11+ Question Solved

Related Book For

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted:

Students also viewed these Business questions

-

Presented below is the trial balance of Vivaldi SpA at December 31, 2019. Instructions Prepare a statement of financial position at December 31, 2019, for Vivaldi SpA. (Ignore income taxes.) Debit...

-

Presented below is the trial balance of Thompson Ltd. at December 31, 2019. A physical count of inventory on December 31 resulted in an inventory amount of £64,000; thus, cost of goods sold for...

-

Presented below is the trial balance of Vivaldi SpA at December 31, 2022. Instructions Prepare a statement of financial position at December 31, 2022, for Vivaldi SpA. Ignore income taxes. Debit...

-

In general, algorithms are classified into paradigms like: greedy, dynamic, optimization, brute-force, and divide & conquer. Each of the following phrases describes one of these paradigm 1) A...

-

Military terminology and strategy are often used in dealing with global competitors. In your opinion, is there any risk in doing so? Is there a risk in failing to do so? Why?

-

Calculate Ted Bakers current ratio and acid test for 2010/11 and 2009/10.

-

1 What limitations can you see in the theories and evidence presented? For example, is Hofstedes analysis of different cultures threatened by the increasingly international outlook and interests of...

-

A plane wall of a furnace is fabricated from plain carbon steel (k = 60 W/m K, p = 7850 kg/m 3 , c = 430 J/kg K) and is of thickness L = 10 mm. To protect it from the corrosive effects of the...

-

Tisha received a lump-sum payment of $4,000. The payment is for Social Security benefits that were due to her in 1990 ($3,000) and 1991 ($1,000). For the current year, she has a marginal tax rate of...

-

The comparative statements of financial position of Lopez Inc. at the beginning and the end of the year 2015 appear on the next page. Net income of $34,000 was reported, and dividends of $13,000 were...

-

Presented below is the adjusted trial balance of Abbey Corporation at December 31, 2015. Additional information: 1. Net loss for the year was 2,500. 2. No dividends were declared during 2015....

-

Carol and Sam Foyle own Campus Fashions. From its inception Campus Fashions has sold merchandise on either a cash or credit basis, but no credit cards have been accepted. During the past several...

-

Consider the following account balances (in thousands) for the Shaker Corporation In the Dec 31.2021 Cash $200,000 and Capital $2,000,000 and Retained earnings $1,500,000 The balances of raw...

-

Unless otherwise stated, assume gravitational acceleration g = 9.81 m/s and the density of water to be 1000 kg/m. Unless otherwise stated, give all numerical answers to 3 significant figures, such as...

-

The purpose of this installment is to classify stock, bond, and mutual fund investments, explore tools for their evaluation and select these securities based on your investment philosophy and goals....

-

Jackson County Senior Services is a nonprofit organization devoted to providing essential services to seniors who live in their own homes within the Jackson County area. Three services are provided...

-

Caldwell (2003) explores differences between the roles of leaders and managers. "Leaders...envision, initiate, or sponsor strategic change of a far-reaching or transformational nature. In contrast,...

-

A quarterback throws a football at a target marked out on the ground 40 yards from his position. Assume that the PDF for the footballs hitting the target is Gaussian within the plane of the target....

-

This problem continues the Draper Consulting, Inc., situation from Problem 12-45 of Chapter 12. In October, Draper has the following transactions related to its common shares: Oct 1 Draper...

-

Comparative balance sheet accounts of Jensen Limited, which follows IFRS, appear below: JENSEN LIMITED Balance Sheet Accounts December 31, 2011, and 2010 Data from Jensens 2011 income statement...

-

The unclassified balance sheet accounts for Sorkin Corporation, which is a public company using IFRS, for the year ended December 31, 2011, and its statement of comprehensive income and statement of...

-

Ashley Limited, which follows ASPE, had the following information available at the end of 2011: Instructions (a) Prepare a statement of cash flows for Ashley Limited using the direct method,...

-

Pottery Ranch Inc. has been manufacturing its own finials for its curtain rods. The company is currently operating at 100% of capacity, and variable manufacturing overhead is charged to production at...

-

3. How much life insurance do you need? Calculating resources - Part 2 Aa Aa E Paolo and Maria Rossi have completed Step 1 of their needs analysis worksheet and determined that they need $2,323,000...

-

On March 1, LGE asks to extend its past-due $1,200 account payable to Tyson, Tyson agrees to accept $200 cash and a 180-day, 8%, $1,000 note payable to replace the account payable. (Use 360 days a...

Study smarter with the SolutionInn App