Schmitt Company must make computations and adjusting entries for the following independent situations at December 31, 2015.

Question:

Schmitt Company must make computations and adjusting entries for the following independent situations at December 31, 2015.

1. Its line of amplifiers carries a 3-year assurance-type warranty against defects. On the basis of past experience, the estimated warranty costs related to dollar sales are first year after sale—2% of sales;

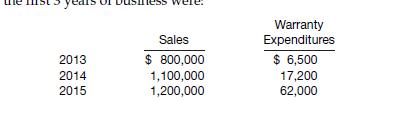

second year after sale—3% of sales; and third year after sale—5% of sales. Sales and actual warranty expenditures for the first 3 years of business were:

Instructions Compute the amount that Schmitt Company should report as a liability in its December 31, 2015, statement of financial position. Assume that all sales are made evenly throughout each year with warranty expenses also evenly spaced relative to the rates above.

2. With some of its products, Schmitt Company includes coupons that are redeemable in merchandise. The coupons have no expiration date and, in the company’s experience, 40% of them are redeemed. The liability for unredeemed coupons at December 31, 2014, was \($9\),000. During 2015, coupons worth \($30\),000 were issued, and merchandise worth \($8\),000 was distributed in exchange for coupons redeemed.

Instructions Compute the amount of the liability that should appear on the December 31, 2015, statement of financial position.

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield