The comparative statements of financial position of Lopez Inc. at the beginning and the end of the

Question:

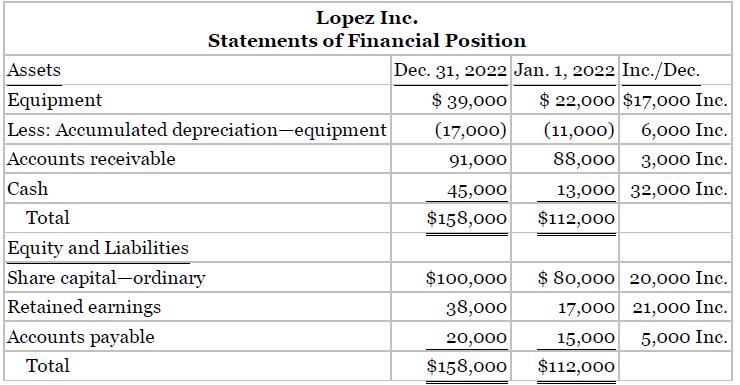

The comparative statements of financial position of Lopez Inc. at the beginning and the end of the year 2022 appear as follows.

Net income of $34,000 was reported, and dividends of $13,000 were paid in 2022. New equipment was purchased and none was sold.

Instructions

Prepare a statement of cash flows for the year 2022.

Transcribed Image Text:

Lopez Inc. Statements of Financial Position Assets Dec. 31, 2022 Jan. 1, 2022 Inc./Dec. Equipment $ 39,000 $ 22,000 $17,000 Inc. Less: Accumulated depreciation-equipment (17,000) (11,000) 6,00o Inc. Accounts receivable 91,000 88,000 3,000o Inc. Cash 45,000 13,000 32,000 Inc. Total $158,000 $112,000 Equity and Liabilities Share capital-ordinary Retained earnings $100,000 $ 80,000 20,000 Inc. 38,000 17,000 21,000 Inc. Accounts payable 20,000 15,000 5,000 Inc. Total $158,000 $112,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

Here we will divide the cash flows into three activities as we are going to solve the problem throug...View the full answer

Answered By

Prashant Sharma

As I am DBF fro IUT , I have caliber to teach and full fill all academic needs like in teaching and training all the relevant subjects,preparations of assignments preparations of exams and any other problems related to educations, I give you very updated guidances and directions to our esteemed students.

0.00

0 Reviews

10+ Question Solved

Related Book For

Intermediate Accounting IFRS

ISBN: 9781119607519

4th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted:

Students also viewed these Business questions

-

The comparative statements of financial position for Ramirez Company as of December 31 are presented on the shown below. Additional information: 1. Operating expenses include depreciation expense of...

-

The comparative statements of financial position for Amaral Reis Company SA as of December 31 are presented as follows. Additional information: 1. Operating expenses include depreciation expense of...

-

The comparative statements of financial position for Sergipe Company show these changes in non-cash current asset accounts: accounts receivable decrease R$80.000, prepaid expenses increase R$28,000,...

-

This is similar to Section 2.2 Problem 28: Use algebraic simplifications to find the limit. Use a fraction. 2x-6 lim x+3x-9 =

-

Find the length of the curve y-I1.rt _ 1 dt 1 16

-

Using Income Statements Given the following information for Mama Mia Pizza Co., calculate the depreciation expense: sales = $34,000; costs = $16,000; addition to retained earnings = $4,300; dividends...

-

Identify the main difference between journal entries in process costing and the ones in job costing.

-

Hahn Company uses a job-order costing system. Its plant wide predetermined overhead rate uses direct labor-hours as the allocation base. The company pays its direct laborers $15 per hour. During the...

-

The following exhibit is for Kmart bonds. Bonds Close Yield Volume Net Change Kmart 8 3/817 100 8.4 35 +7/8 The contractual interest rate of the K mart bonds is a. greater than the market interest...

-

The City of Bernard starts the year of 2015 with the following unrestricted amounts in its general fund: cash of $20,000 and investments of $70,000. In addition, it holds a small building bought on...

-

Presented below is a condensed version of the comparative statements of financial position for Yoon Ltd. for the last 2 years at December 31 (amounts in millions). Additional information: Investments...

-

Martinez SA engaged in the following cash transactions during 2022. Sale of land and building ........................... R$191,000 Purchase of treasury shares ............................ 40,000...

-

Which of the costs discussed in the chapter is the most important when a firm is deciding how much to produce?

-

Albert is in third grade and has documented impulsivity issues in class. Develop a plan to teach Albert how to answer questions in class appropriately. He will currently shout out answers and if the...

-

What type of atmosphere is generated in the zara locations? How do the stores draw in their customers? Is there any atmospherics that would make you stay in the stores? Is it enjoyable inside, does...

-

You've been asked to create a machine learning service that helps people choose what concert to attend on a particular date based on the type of music they prefer, who is singing, and where the event...

-

What are the lessons (human resource, marketing, services, location, pricing, etc.) that Disney learned from its previous international ventures (Japan, EDL, HK)? What were some of the mistakes and...

-

17.C. a. A person asks you to convert a given point (x,y) into polar coordinates (r, 0). Explain how this might be an ambiguous question (i.e., is further information needed?). b. There is only 1 out...

-

This unadjusted trial balance is for Challenger Construction at the end of its fiscal year, September 30, 2020. The beginning balance of the owner?s capital account was $46,000 and the owner invested...

-

Funds are separate fiscal and accounting entities, each with its own self-balancing set of accounts. The newly established Society for Ethical Teachings maintains two funds-a general fund for...

-

Analysis of Receivables Presented below is information for Grant Company. 1. Beginning-of-the-year Accounts Receivable balance was $15,000. 2. Net sales (all on account) for the year were $100,000....

-

Transfer of Receivables Use the information for Grant Company as presented in E7-20. Grant is planning to factor some accounts receivable at the end of the year. Accounts totaling $10,000 will be...

-

Bank Reconciliation and Adjusting Entries Presented below is information related to Haselhof Inc. Balance per books at October 31, $41,847.85; receipts $173,523.91; disbursements $164,893.54. Balance...

-

question 6 Timely Inc. produces luxury bags. The budgeted sales and production for the next three months are as follows july. august september Sales, in units 1,115. 1229. 1302 Production. in units...

-

On May 12 Zimmer Corporation placed in service equipment (seven-year property) with a basis of $220,000. This was Zimmer's only asset acquired during the year. Calculate the maximum depreciation...

-

Power Manufacturing has equipment that it purchased 7 years ago for $2,550,000. The equipment was used for a project that was intended to last for 9 years and was being depreciated over the life of...

Study smarter with the SolutionInn App