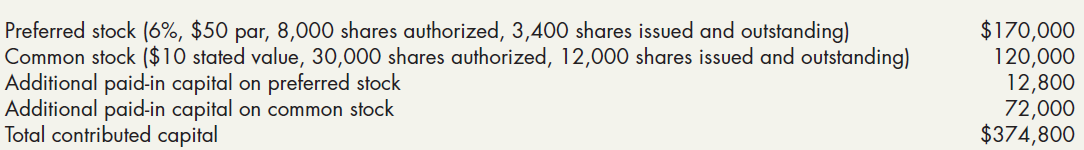

Byrd Companys Contributed Capital section of its January 1, 2019, balance sheet is as follows: During 2019,

Question:

Byrd Company’s Contributed Capital section of its January 1, 2019, balance sheet is as follows: During 2019, Byrd entered into the following transactions:

During 2019, Byrd entered into the following transactions:

Jan. 4 Established a compensatory share option plan for its key executives. The options vest after a 3-year service period. The estimated fair value of the options expected to be exercised is $81,000.

Apr. 23 Sold 300 shares of preferred stock at $55 per share.

June 7 Sold 600 shares of common stock at $17 per share.

Sept. 21 Purchased building by paying $9,000 cash and issuing 800 shares of common stock and 450 shares of preferred stock. Common and preferred stock are currently selling for $19 and $57 per share, respectively.

Oct. 12 Reacquired 900 shares of common stock at $19.50 per share. The company uses the cost method to account for treasury stock.

Nov. 15 Issued for $32,000 a combination of 700 shares of common stock and 12% bonds with a face value of $20,000. The common stock is currently selling for $18 per share. No market value exists for the bonds.

Dec. 14 Reissued the 900 shares of treasury stock at $20.50 per share.

28 Distributed a $3.00-per-share dividend on all outstanding preferred stock and a $1.50-per-share dividend on all common stock outstanding on this date (debit Retained Earnings and credit Cash for each dividend).

Required:

1. Prepare memorandum and journal entries to record the preceding transactions.

2. Prepare the Contributed Capital section of Byrd’s December 31, 2019, balance sheet.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Face Value

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach