Cheadle Company purchased a fleet of 20 delivery trucks for $8,000 each on January 2, 2019. It

Question:

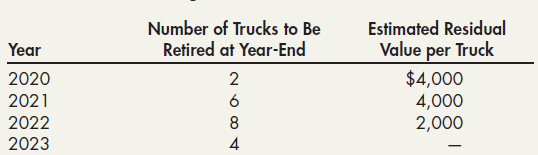

Cheadle Company purchased a fleet of 20 delivery trucks for $8,000 each on January 2, 2019. It decided to use composite depreciation on a straight-line basis and calculated the depreciation from the following schedule:

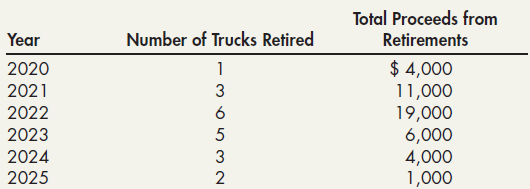

Cheadle actually retired the trucks according to the following schedule (assume each truck was retired at the beginning of the year):

Required:

1. Prepare the journal entries necessary to record the preceding events.

2. Assume that the company expected all the trucks to last 4 years and be retired for $1,600 each. Using group depreciation, prepare journal entries for all 6 years, assuming the company retired the trucks as shown by the latter schedule.

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach