Gire Company began operations at the beginning of 2019 at which time it purchased a depreciable asset

Question:

Gire Company began operations at the beginning of 2019 at which time it purchased a depreciable asset for $60,000. For 2019 through 2022, the asset was depreciated on the straightline basis over a 4-year life (no residual value) for financial reporting. For income tax purposes, the asset was depreciated using MACRS (200%, 3-year life).

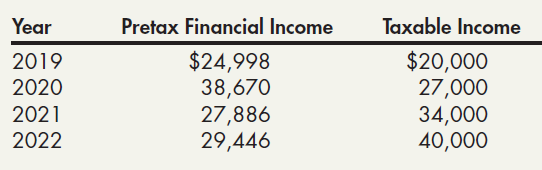

For 2019 through 2022, Gire reported pretax financial income and taxable income of the following amounts (the differences are due solely to the depreciation temporary differences):

Over the entire 4-year period, Gire was subject to an income tax of 30%, and no change in the tax rate had been enacted for future years.

Required:

1. Prepare a schedule that shows for each year, 2019 through 2022, the (a) MACRS depreciation, (b) straightline depreciation, (c) annual depreciation temporary difference, and (d) accumulated temporary difference at the end of each year.

2. Prepare Gire’s income tax journal entry at the end of (a) 2019, (b) 2020, (c) 2021, and (d) 2022. (Round to the nearest dollar.)

3. Prepare the lower portion of Gire’s income statement for (a) 2019, (b) 2020, (c) 2021, and (d) 2022.

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach