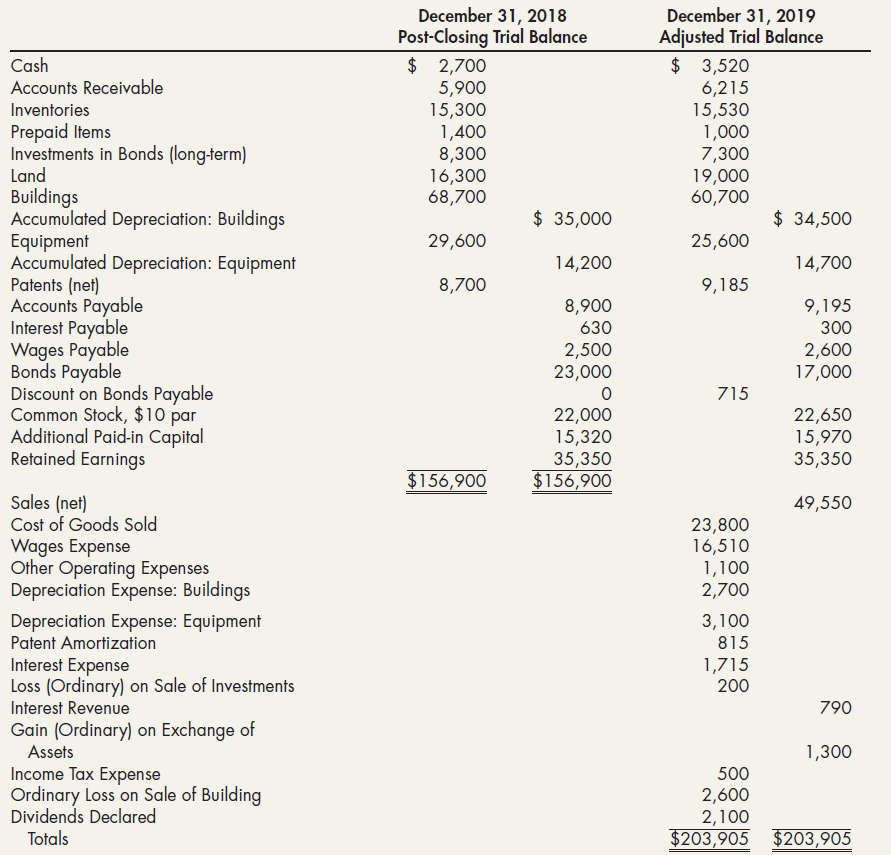

Heinz Companys post-closing trial balance as of December 31, 2018, and the adjusted trial balance as of

Question:

Heinz Company’s post-closing trial balance as of December 31, 2018, and the adjusted trial balance as of December 31, 2019, are shown here:

A review of the accounting records reveals the following additional information:

a. Bonds payable with a face value, book value, and market value of $14,000 were retired on June 30, 2019.

b. Bonds payable with a face value of $8,000 were issued at 90.25 on August 1, 2019. They mature on August 1, 2024. The company uses the straight-line method to amortize the bond discount.

c. The company sold a building that had an original cost of $8,000 and a book value of $4,800. The company received $2,200 in cash for the building and recorded a loss of $2,600.

d. Equipment with a cost of $4,000 and a book value of $1,400 was exchanged for an acre of land valued at $2,700. No cash was exchanged.

e. Long-term investments in bonds being held to maturity with a cost of $1,000 were sold for $800.

f. Sixty-five shares of common stock were exchanged for a patent. The common stock was selling for $20 per share at the time of the exchange.

Required:

Prepare a spreadsheet to support a statement of cash flows for 2019.

Face value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach