In 2020, Frost Company, which began operations in 2018, decided to change from LIFO to FIFO because

Question:

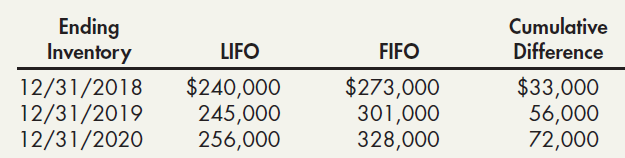

In 2020, Frost Company, which began operations in 2018, decided to change from LIFO to FIFO because management believed that FIFO better represented the flow of their inventory. Management prepared the following analysis showing the effect of this change:

Frost reported net income of $2,500,000, $2,400,000, and $2,100,000 in 2018, 2019, and 2020, respectively. The tax rate is 21%.

Required:

1. Prepare the journal entry necessary to record the change.

2. What amount of net income would Frost report in 2018, 2019, and 2020?

3. If Frost’s employees received a bonus of 10% of income before deducting the bonus and income taxes in 2018 and 2019, what would be the effect on net income for 2018, 2019, and 2020?

Ending Inventory Cumulative Difference LIFO FIFO $240,000 245,000 256,000 $273,000 301,000 328,000 $33,000 56,000 72,000 12/31/2018 12/31/2019 12/31/2020

Step by Step Answer:

1 Inventory 56000 Deferred Tax Liability 56000 21 11760 Retained Earnings 44240 2 2018 2019 2020 Rep...View the full answer

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Students also viewed these Business questions

-

Harris Company, which began operations in 2013, invests its idle cash in trading securities. The following transactions relate to its short- term investments in its trading securities. 2013 Mar. 10...

-

In 2017, Frost Company, which began operations in 2015, decided to change from LIFO to FIFO because management believed that FIFO better represented the flow of their inventory. Management prepared...

-

In 2014, Frost Company, which began operations in 2012, decided to change from LIFO to FIFO because management believed that FIFO better represented the flow of their inventory. Management prepared...

-

What responsibilities can a Crew Boss delegate to a subordinate supervisor? (Select all that apply) Re-supplying crew and equipment Communicating crew wake up time for next operational period...

-

Describe the effect of left or right multiplication by a matrix that is in the canonical form for nilpotent matrices.

-

Looking back at the EquiCredit example we used to open the chapter, why would you say EquiCredit used a swap agreement? In other words, why didnt EquiCredit just go ahead and issue fixed-rate bonds...

-

Does it matter whether the surcharge is called a gratuity or a service charge? How would that be determined?

-

Union Company is considering establishment of a zero-balance account. The firm currently maintains an average balance of $420,000 in its disbursement account. As compensation to the bank for...

-

8. When we are trying to form the optimal risky portfolio from hundreds or thousands of risky securities, the efficient frontier typically if we disallow short selling. (a) moves to the northwest (b)...

-

(a) Prepare the following consolidated financial statements for Year 6: (i) Income statement (ii) Statement of financial position (b) Calculate goodwill impairment loss and profit attributable to...

-

Delta Oil Company uses the successful-efforts method to account for oil exploration costs. Delta started business in 2017 and prepared the following income statements: The company chooses to change...

-

Gundrum Company purchased equipment on January 1, 2015 for $850,000. The equipment was expected to have a useful life of 10 years and a salvage value of $30,000. Gundrum uses the straight-line method...

-

Consider the following quantum number combinations, with, in every case B = 1 and T = 0: Q, C, S, B = 1, 0, 3, 0; Q, C, S, B = 2, 1, 0, 0; Q, C, S, B = 1, 1, 1, 0; Q, C, S, B = 0, 1, 2, 0; Q, C, S, B...

-

The following information about the payroll for the week ended December 30 was obtained from the records of Saine Co.: Salaries: Sales salaries Deductions: $180,000 Income tax withheld $65,296...

-

You have just been hired as the chief executive officer (CEO) in a medium-sized organization. The organization is not suffering financially, but neither is it doing as well as it could do. This is...

-

The following is the selling price and cost information about three joint products: X Y Z Anticipated production 1 2 , 0 0 0 lbs . 8 , 0 0 0 lbs . 7 , 0 0 0 lbs . Selling price / lb . at split - off...

-

calculate the maximum bending compressive stress of the following section under NEGATIVE bending moment of 216KN.m. 216mm 416mm 316mm 115mm

-

Need assistance with the following forms: 1040 Schedule 1 Schedule 2 Schedule C Schedule SE Form 4562 Form 8995 Appendix B, CP B-3 Christian Everland (SS number 412-34-5670) is single and resides at...

-

It is possible to modify the B+-tree insertion algorithm to delay the case where a new level is produced by checking for a possible redistribution of values among the leaf nodes. Figure 17.17...

-

What is your opinion of advertising awards, such as the Cannes Lions, that are based solely on creativity? If you were a marketer looking for an agency, would you take these creative awards into...

-

You have been asked by a client to review the records of Roberts Company, a small manufacturer of precision tools and machines. Your client is interested in buying the business, and arrangements have...

-

Cullen Construction Company, which began operations in 2025, changed from the cost-recovery to the percentage-of-completion method of accounting for long-term construction contracts during 2026. For...

-

At the beginning of 2025, Wertz Construction Company changed from the cost- recovery method to recognizing revenue over time (percentage-of-completion) for financial reporting purposes. The company...

-

Hrubec Products, Incorporated, operates a Pulp Division that manufactures wood pulp for use in the production of various paper goods. Revenue and costs associated with a ton of pulp follow: Selling...

-

The AICPA guidelines suggest that taxes should be transparent and visible. This means that: a. The taxes affect similarly situated taxpayers in a similar manner. b. Taxes should be due at the same...

-

What is Apple Companys strategy for success in the marketplace? Does the company rely primarily on customer intimacy, operational excellence, or product leadership? What evidence supports your...

Study smarter with the SolutionInn App