Lorien Company wishes to prepare a forecasted income statement, a forecasted balance sheet, and a forecasted statement

Question:

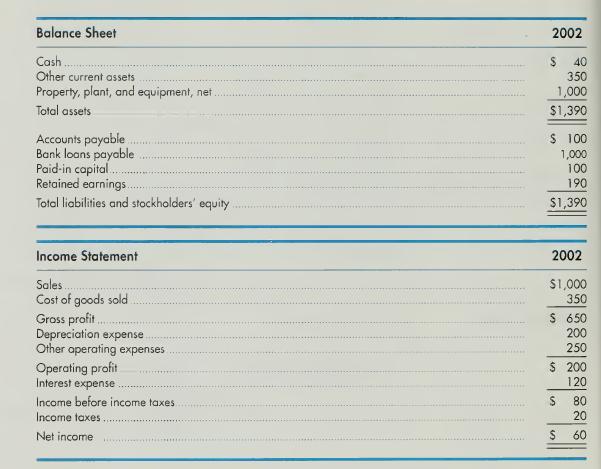

Lorien Company wishes to prepare a forecasted income statement, a forecasted balance sheet, and a forecasted statement of cash flows for 2003. Lorien's balance sheet and income statement for 2002 are given below.

In addition, Lorien has assembled the following forecasted information for 2003.

(a) Sales are expected to increase to \($1,200\).

(b) Lorien does not expect to buy any new property, plant, and equipment during 2003- (Think about how depreciation expense in 2003 will affect the reported amount of property plant, and equipment.)

(c) Because of adverse banking conditions, Lorien does not expect to receive any new bank loans in 2003.

(d) Lorien plans to pay cash dividends of \($15\) in 2003.

Instructions:

1. Prepare a forecasted balance sheet, a forecasted income statement, and a forecasted statement of cash flows for 2003. Clearly state what assumptions you make. Use the indirect method for reporting cash from operating activities.

2. If you have constructed your forecasted cash flow statement correctly, you will see that Lorien plans to distribute cash to shareholders through two different means in 2003. Which of these methods involves distributing an equal amount of cash for each share owned? Which of these methods channels the cash to shareholders who are the least optimistic about the prospects of the company?

Step by Step Answer:

Intermediate Accounting

ISBN: 9780324013078

14th Edition

Authors: Fred Skousen, James Stice, Earl Kay Stice