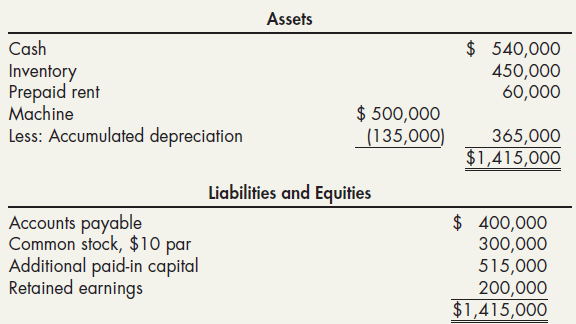

Lurch Companys December 31, 2018, balance sheet follows: During 2019, the following transactions occurred: 1. To avoid

Question:

Lurch Company’s December 31, 2018, balance sheet follows:

During 2019, the following transactions occurred:

1. To avoid paying monthly rent of $5,000 on existing plant facilities, the company decided to buy a tract of land and construct a building of its own on it. On January 2, 2019, Lurch exchanged 6,000 shares of its common stock to acquire the land; the stock was selling for $25 per share. Construction of the building also began on January 2, 2019. At the time, Lurch borrowed funds by issuing a 1-year, $500,000 note at 12% to help finance the project. The principal and interest on the note are due January 3, 2020. Construction costs (paid in cash) that occurred evenly throughout the year totaled $700,000. The building was completed on December 30, 2019, and the move-in to the new building was to occur during the next week.

2. On January 2, 2019, Lurch exchanged its one existing machine plus $50,000 for a newer machine with a fair value of $430,000. The new machine is to be depreciated using straight-line depreciation based on an economic life of 5 years and a residual value of $55,000.

3. Lurch uses a FIFO perpetual inventory system. Lurch sold $350,000 of its inventory for $700,000 cash, paid for its beginning accounts payable, and purchased $480,000 of inventory on account during the year.

4. On July 31, 2019, Lurch declared and paid a $2.50 per share cash dividend to its shareholders.

5. Lurch is subject to a 21% income tax rate, and income taxes are accrued at year-end.

Required:

Prepare Lurch’s income statement and statement of retained earnings for the fiscal year ended December 31, 2019, and a balance sheet as of December 31, 2019. Show all supporting journal entries and computations made during 2019.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach