Nickle Company purchased three identical assets for $17,000 on January 2, 2019. Each asset has an expected

Question:

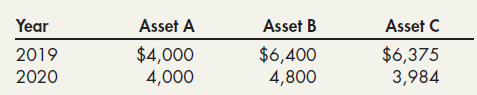

Nickle Company purchased three identical assets for $17,000 on January 2, 2019. Each asset has an expected residual value of $1,000. The depreciation expense for 2019 and 2020 is shown below for three assets:

Required:

1. Next Level Which depreciation method is the company using for each asset?

2. Compute the depreciation expense for 2021 and 2022 for each asset.

Year Asset B Asset C Asset A $4,000 4,000 $6,400 4,800 $6,375 3,984 2019 2020

Step by Step Answer:

Depreciation Base 17000 1000 16000 1 Depreciation method used The str...View the full answer

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

On January 1, 2018, Emming Corporation purchased some machinery. The machinery has an estimated life of 10 years and an estimated residual value of $5,000. The depreciation expense on this machinery...

-

On May 10, 2019, Horan Company purchased equipment for $25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is...

-

Winsey Company purchased equipment on January 2, 2019, for $700,000. The equipment has the following characteristics: Estimated service life 20 years, ..........100,000 hours, 950,000 units of output...

-

10. Two great circle arcs on the Earth's surface leading out of London make an angle of 20. One goes to New York City, a distance of 3,046 miles, the other to Santo Domingo in the Dominican Republic,...

-

What is the electric field at x = d (point P)? Positive point charges q and 2q are located at x = 0 and x = 3d, respectively. 2q tx x=0

-

Find the real solutions of each equation. 1 (x + 1) 1 x + 1 +2

-

(Retained Earnings Statement, Prior Period Adjustment) Below is the retained earnings account for the year 2004 for LeClair Corp. Instructions (a) Prepare a corrected retained earnings statement....

-

Smith Accounting Services is considering a special order that it received from one of its corporate clients. The special order calls for Smith to prepare the individual tax returns of the...

-

El 1 de agosto, corporacin Shaw LLC. compr 1,000 acciones ordinarias de Estrella Corp. por $37,000 en efectivo. El 1 de diciembre, Shaw LLC. vendi la inversin en acciones ordinarias de Estrella Corp....

-

Betsy and Rich Crosmour are married with two children. Rich is a chef and Betsy is a designer. This information was reported on their W-2 forms. Betsy and Rich received $1,287.43 in interest on bank...

-

Sorter Company purchased equipment for $200,000 on January 2, 2019. The equipment has an estimated service life of 8 years and an estimated residual value of $20,000. Required: Compute the...

-

On January 2, 2019, Lapar Corporation purchased a machine for $50,000. Lapar paid shipping expenses of $500, as well as installation costs of $1,200. The company estimated that the machine would have...

-

Suppose that States \(K\) and \(L\) annex State \(M\) and increase the house size proportionately. a. Determine the new house size, \(m\), that is necessary. b. Calculate the standard divisor based...

-

CASE 7.2 Oracle Corporation: Share-Based Compensation Effects/Statement of Shareholders' Equity A sales-based ranking of software companies provided by Yahoo! Finance on November 5, Year 8, places...

-

A manufacturer of ovens sells them for $1,450 each. The variable costs are $800 per unit. The manufacturer's factory has annual fixed costs of $1,735,000. a. Given the expected sales volume of 3,100...

-

1.1 Explain the vitality of a strategy on businesses like Dell. (15) 1.2 Critically discuss the underlying objectives Dell should follow when formulating its business strategy. (20) 1.3 Discuss the...

-

Our international business plan involves exporting a sustainable apparel brand from India to UK. We will be exploring this plan in further detail below: Product/ Service: Sustainable clothing line...

-

If X is a random variable with probability density function f given by: f (x) = 4x 4x 3 when 0 x 1 and 0 otherwise, compute the following quantities: (a) The cumulative distribution function F...

-

Evaluate the expressions in Problem 8 P 5

-

Air pollution generated by a steel mill is an example of a) a positive production externality. b) a negative production externality. c) a public good. d) the free-rider problem. State and local taxes...

-

Howard Corporation had 10,000 shares of common stock outstanding at the beginning of the year. On July 1, it issued 5,000 shares, and on September 1, it reacquired 600 shares as treasury stock. What...

-

Aiken Corporation has compensatory share options for employees to purchase 4,000 common shares at $12 per share outstanding the entire year. The average market price for the common stock during the...

-

Keener Company has had 1,000 shares of 7%, $100 par preferred stock and 40,000 shares of $5 stated LO 16.1 value common stock outstanding for the last 3 years. During that period, dividends paid...

-

The tolal landed coet with the order gaantly sire of 6,000 unts is 4 (Enter your response roundod to the nearest dolar)

-

Boyne Inc. had beginning inventory of $12,000 at cost and $20,000 at retail. Net purchases were $120,000 at cost and $170,000 at retail. Net markups were $10,000, net markdowns were $7,000, and sales...

-

Apple inc. CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) (In milions, except number of shares which are reflected in thousands and par value) LABILITES AND SHAREHOLDERS' EQUITY: Current...

Study smarter with the SolutionInn App