On September 1, 2019, a company borrowed cash and signed a 1-year, interest-bearing note on which both

Question:

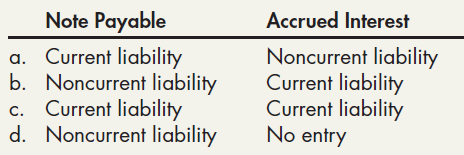

On September 1, 2019, a company borrowed cash and signed a 1-year, interest-bearing note on which both the principal and interest are payable on September 1, 2021. How will the note payable and the related interest be classified in the December 31, 2019, balance sheet?

Transcribed Image Text:

Accrued Interest Noncurrent liability Current liability Current liability Note Payable a. Current liability b. Noncurrent liability Current liability d. Noncurrent liability C. No entry

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (9 reviews)

c Curren...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Question Posted:

Students also viewed these Business questions

-

Multiple Choice Questions 1. APB Opinion No. 22, Disclosure of Accounting Policies a. Requires a description of every accounting policy followed by a reporting entity b. Provides a specific listing...

-

Multiple Choice Questions 1. A donated fixed asset (from a governmental unit) for which the fair value has been determined should be recorded as a debit to Fixed Assets and a credit to: a....

-

(Multiple Choice) 1. Which of the following is classified as an accrued payroll liability? Federal Income Employees Share Tax Withheld of F.I.C.A. Taxes a. No ............Yes b. No ............ No c....

-

Jake Drewrey has total fixed monthly expenses of $ 1,340 and his gross monthly income is $3,875. What is his debt-to-income ratio? How does his ratio compare to the desired ratio?

-

There are two identical containers of gas at the same temperature and pressure, one containing argon and the other neon. What is the ratio of the rms speed of the argon atoms to that of the neon...

-

Hallick, Inc. has a fiscal year ending June 30. Taxable income was $5,000,000 for its year ended June 30, 2018, and it projects similar taxable income for its 2023 fiscal year. a. Compute Hallicks...

-

how to find and interpret the standard error of a sampling distribution

-

Microtech Corporation and Webnet Solutions, Inc. have identical balance sheets, as follows (in millions): Assets Current assets...

-

What is the difference between a perpetuity and an annuity? Define each.

-

According to the World Almanac, 35.2% of men ages 18 to 44 meets the U.S. Fitness Guidelines. How large a sample is necessary to estimate the true proportion of men that are fit in this age group...

-

The inventory records of Frost Company for the years 2019 and 2020 reveal the cost and market of the January 1, 2019, inventory to be $125,000. On December 31, 2019, the cost of inventory was...

-

Bronson Apparel Inc. operates a retail store and must determine the proper December 31, 2019, year-end accrual for the following expenses: The store lease calls for fixed rent of $1,000 per month,...

-

The "Pick 3 " at horse racetracks requires that a person select the winning horse for three consecutive races. If the first race has nine entries, the second race eight entries, and the third race...

-

You will be creating a Performance Improvement Plan to address an employee in the attached case study (see below). This is a scenario you may encounter in your future HR profession, so this...

-

For this prompt, consider your academic goals, including (but not limited to) such topics as how you plan to manage your time to fit in your studies; how you will build your skills, as needed; how...

-

1. An introduction of you as a leader (whether or not you see yourself as a leader, whether or not you like being a leader, what kinds of leadership roles you have had, etc.). 2. Summarize your...

-

Briefly, describe the firm in terms of the following items. a. Size in terms of market capitalization, annual revenue, number of employees, location(s). b. Discuss the financial position of the firm....

-

HealthyLife (HL) is a publicly-traded company in the Food Manufacturing Industry. HealthyLife has been around since the 1970s, and is mainly focused on the production and wholesale of "organic and...

-

Given M in Problem find M -1 and show that M -1 M = I. 1 -3 1 1 2 -1 4

-

State whether each statement is true or false. If false, give a reason. {purple, green, yellow} = {green, pink, yellow}

-

On January 1, 2013, Lynch Company acquired 13% bonds with a face value of $50,000. The bonds pay interest on June 30 and December 31 and mature on December 31, 2015. Lynch paid $51,229.35, a price...

-

Southeast Bank invests in trading securities and prepares quarterly financial statements. At the beginning of the fourth quarter of 2013, the bank held as trading securities 200 shares of Eglan...

-

On January 1, 2013, Hyde Corporation purchased bonds with a face value of $300,000 for $308,373.53. The bonds are due June 30, 2016, carry a 13% stated interest rate, and were purchased to yield 12%....

-

Milano Pizza is a small neighborhood pizzeria that has a small area for in-store dining as well as offering take-out and free home delivery services. The pizzerias owner has determined that the shop...

-

Which of the following statement regarding a post-closing trial balance is not true

-

What are the benefits and potential risks factors for undertaking derivative strategies compared to cash transactions

Study smarter with the SolutionInn App