Presented below are the comparative income and retained earnings statements for Denise Habbe Inc. for the years

Question:

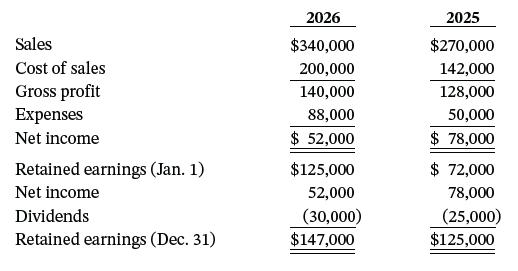

Presented below are the comparative income and retained earnings statements for Denise Habbe Inc. for the years 2025 and 2026.

The following additional information is provided:

1. In 2026, Denise Habbe Inc. decided to switch its depreciation method from sum-of-the-years’ digits to the straight-line method. The assets were purchased at the beginning of 2025 for $100,000 with an estimated useful life of 4 years and no salvage value. (The 2026 income statement contains depreciation expense of $30,000 on the assets purchased at the beginning of 2025.)

2. In 2026, the company discovered that the ending inventory for 2025 was overstated by $24,000; ending inventory for 2026 is correctly stated.

Instructions

Prepare the revised retained earnings statement for 2025 and 2026, assuming comparative statements.

Step by Step Answer:

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield