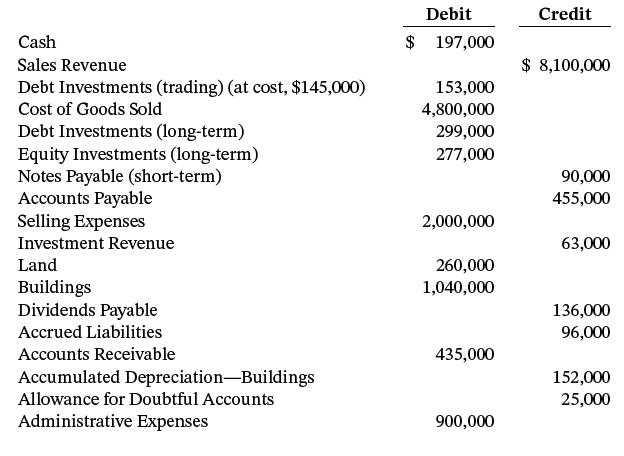

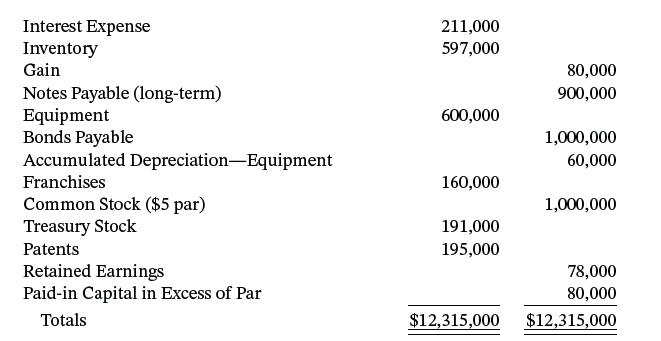

Presented below is the trial balance of Scott Butler Corporation at December 31, 2025. Instructions Prepare a

Question:

Presented below is the trial balance of Scott Butler Corporation at December 31, 2025.

Instructions

Prepare a balance sheet at December 31, 2025, for Scott Butler Corporation. (Ignore income taxes.)

Transcribed Image Text:

Cash Sales Revenue Debt Investments (trading) (at cost, $145,000) Cost of Goods Sold Debt Investments (long-term) Equity Investments (long-term) Notes Payable (short-term) Accounts Payable Selling Expenses Investment Revenue Land Buildings Dividends Payable Accrued Liabilities Accounts Receivable Accumulated Depreciation-Buildings Allowance for Doubtful Accounts Administrative Expenses Debit $ 197,000 153,000 4,800,000 299,000 277,000 2,000,000 260,000 1,040,000 435,000 900,000 Credit $ 8,100,000 90,000 455,000 63,000 136,000 96,000 152,000 25,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

Scott Butler Corporation Balance Sheet December 31 2025 Assets Current assets Cash 197000 Debt inves...View the full answer

Answered By

Deborah Joseph

My experience has a tutor has helped me with learning and relearning. You learn everyday actually and there are changes that are made to the curriculum every time so being a tutor has helped in keeping me updated about the present curriculum and all.

I have also been able to help over 100 students achieve better grades particularly in the categories of Math and Biology both in their internal examinations and external examinations.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted:

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

Sherry and John Enterprises are using the kaizen approach to budgeting for 2011. The budgeted income statement for January 2011 is as follows: Sales (168,000 units) $1,000,000 Less: Cost of goods...

-

Let be integrable on the real line with respect to Lebesgue measure. Evaluate limf (x n) (x/1+x) dx. Justify all steps.

-

Presented below is the trial balance of Scott Butler Corporation at December 31, 2014. Debit Credit Cash $200,430 Sales $8,101,350 Debt Investments (trading) (cost, $145,000) 154,350 Cost of Goods...

-

Gabriele Enterprises has bonds on the market making annual payments, with seven years to maturity, a par value of $1,000, and selling for $974. At this price, the bonds yield 7.2 percent. What must...

-

During 2010, an estate generated income of $20,000: Rental income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $9,000 Interest income . . . . . . . . . . . . . . . . . . . . . . ....

-

If a firm has no mutually exclusive projects, only independent ones, and it also has both a constant required rate of return and projects with conventional cash flow patterns, then the NPV and IRR...

-

Have you ever caught someone elses emotions? If so, how could you have utilized self-awareness and self-control to protect yourself from taking on the negative emotions of others? (p. 56)

-

What are the ethical implications for leaders who ignore the impacts of severe workplace stress on their employees?

-

3 4 7 First Choice Ltd. completed the following merchandising transactions in the month of May 2021. At the beginning of May, First Choice's ledger showed Cash $7,200; Accounts Receivable $2,000;...

-

The New York Knicks, Inc. sold 10,000 season tickets at $2,000 each. By December 31, 2025, 16 of the 40 home games had been played. What amount should be reported as a current liability at December...

-

Presented below is the adjusted trial balance of Kelly Corporation at December 31, 2025. Additional information: 1. Net loss for the year was $2,500. 2. No dividends were declared during 2025....

-

Find the derivative of the function. y = (3x + 5)x

-

A new partner C is invited to join in the AB partnership. Currently, A's and B's capital are $540,000 and $100,000, respectively. According to their profit and loss sharing contract, partner A and B...

-

The two tanks shown are connect through a mercury manometer. What is the relation between ???? and ? water Az water Ah

-

1. After reading about the types of rights that prisoners have while incarcerated, which of these rights, if any, should be reduced or diminished? Why? 2. In the same way, what rights do you believe...

-

According to the Socratic view of morality summarized by Frankena, is a person brought up by immoral parents in a corrupt society capable of making correct moral judgements? Why or why not? Do you...

-

Loma Company manufactures basketball backboards. The following information pertains to the company's normal operations per month: Output units15,000 boards Machine-hours4,000 hours Direct...

-

Martinez Corporation's sales of gizmos are 25% forcash and 75% on credit. Past collection history indicates that credit sales are collected as follows: In January, sales were $80,000 and February...

-

Evaluate the integral, if it exists. Jo y(y + 1) dy

-

Recognition of RevenueTheory the earning of revenue by a business enterprise is recognized for accounting purposes when the transaction is recorded. In some situations, revenue is recognized...

-

Recognition of Revenue'Bonus Dollars Griseta & Dubel Inc. was formed early this year to sell merchandise credits to merchants who distribute the credits free to their customers. For example,...

-

Recognition of Revenue'Bonus Dollars Griseta & Dubel Inc. was formed early this year to sell merchandise credits to merchants who distribute the credits free to their customers. For example,...

-

Compute the value of ordinary bonds under the following circumstances assuming that the coupon rate is 0.06:(either the correct formula(s) or the correct key strokes must be shown here to receive...

-

A tax-exempt municipal bond has a yield to maturity of 3.92%. An investor, who has a marginal tax rate of 40.00%, would prefer and an otherwise identical taxable corporate bond if it had a yield to...

-

Please note, kindly no handwriting. Q. Suppose a 3 year bond with a 6% coupon rate that was purchased for $760 and had a promised yield of 8%. Suppose that interest rates increased and the price of...

Study smarter with the SolutionInn App