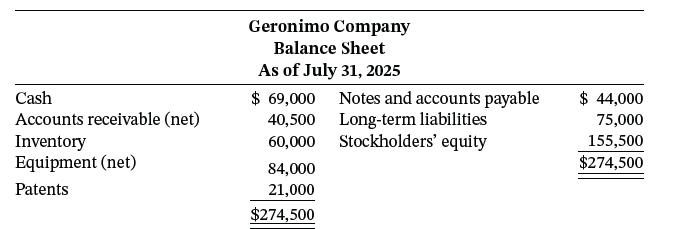

The bookkeeper for Geronimo Company has prepared the following balance sheet as of July 31, 2025. The

Question:

The bookkeeper for Geronimo Company has prepared the following balance sheet as of July 31, 2025.

The following additional information is provided.

1. Cash includes $1,200 in a petty cash fund and $15,000 invested in a 24-month certificate of deposit.

2. The net accounts receivable balance is comprised of the following two items: (a) accounts receivable $44,000 and (b) allowance for doubtful accounts $3,500.

3. Inventory costing $5,300 was shipped out on consignment on July 31, 2025. The ending inventory balance does not include the consigned goods. Receivables in the amount of $5,300 were recognized on these consigned goods.

4. Equipment had a cost of $112,000 and an accumulated depreciation balance of $28,000.

5. Income taxes payable of $6,000 were accrued on July 31. Geronimo Company, however, had set up a cash fund to meet this obligation. This cash fund was not included in the cash balance but was offset against the income taxes payable amount.

Instructions

Prepare a corrected classified balance sheet as of July 31, 2025, from the available information, adjusting the account balances using the additional information.

Step by Step Answer:

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield