The bookkeeper for the Irwin Wholesale Electric Co. records all revenue and expense items in nominal accounts

Question:

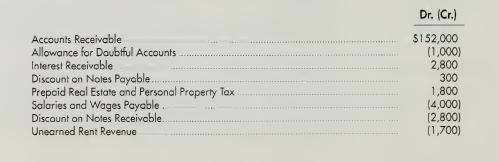

The bookkeeper for the Irwin Wholesale Electric Co. records all revenue and expense items in nominal accounts during the period. The following balances, among others, are listed on the trial balance at the end of the fiscal period, December 31, 2002, before accounts have been adjusted:

Inspection of the company's records reveals the following as of December 31, 2002:

(a) Uncollectible accounts are estimated at 4% of the accounts receivable balance.

(b) The accrued interest on investments totals \($2.200\).

(c) The company borrows cash by discounting its own notes at the bank. Discounts on notes payable at the end of 2002 are \($1,400\).

(d) Prepaid real estate and personal property- taxes are \($1.800.\) the same as at the end of 2001.

(e) Accrued salaries and wages are \($6.200\).

(f) The company accepts notes from customers, giving its customers credit for the face of the note less a charge for interest. At the end of each period, any interest applicable to the succeeding period is reported as a discount. Discounts on notes receivable at the end of 2002 are \($1.900\).

(g) Part of the company's properties had been sublet on September 15, 2001. at a rental of \($3.000\) per month. The arrangement was terminated at the end of one year.

Instructions:

Give the adjusting entries required to bring the books up to date.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780324013078

14th Edition

Authors: Fred Skousen, James Stice, Earl Kay Stice