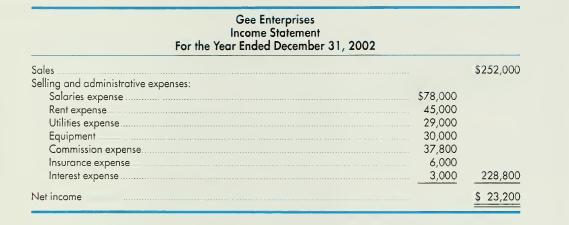

Gee Enterprises records all transactions on the cash basis. Greg Gee. company accountant, prepared the following income

Question:

Gee Enterprises records all transactions on the cash basis. Greg Gee. company accountant, prepared the following income statement at the end of the company's first year of operations.

You have been asked to prepare an income statement on the accrual basis. The , following information is given to you to assist in the preparation.

a. Amounts due from customers at year-end were \($28.000.\) Of this amount. \($3.000\) will probably not be collected.

b. Salaries of \($11,000\) for December 2002 were paid on January 5, 2003. Ignore payroll taxes.

c. Gee rents its building for \($3.000\) a month, payable quarterly in advance. The contract was signed on January 1. 2002.

d. The bill for December's utility costs of \($2.700\) was paid January 10, 2003.

e. Equipment of \($30.000\) was purchased on Januany 1 . 2002. The expected life is 5 years, no salvage value. Assume straight-line depreciation.

f. Commissions of 15% of sales are paid on the same day cash is received from customers.

g. A 1-year insurance policy was issued on company assets on July 1. 2002. Premiums are paid annually in advance.

h. Gee borrowed \($50.000\) for one year on May 1 , 2002. Interest payments based on an annual rate of 12% are made quanerly. beginning with the first payment on August 1,2002.

i. The income tax rate is 40%. No prepayments of income taxes were made during 2002.

Instructions:

1. Prepare adjusting entries to conven the books from a cash to an accrual basis.

2. Prepare the income statement for the year ended December 31, 2002, based on the entries in (1).

Step by Step Answer:

Intermediate Accounting

ISBN: 9780324013078

14th Edition

Authors: Fred Skousen, James Stice, Earl Kay Stice