The following are selected 2025 transactions of Astin Corporation. Instructions a. Prepare journal entries for the selected

Question:

The following are selected 2025 transactions of Astin Corporation.

Instructions

a. Prepare journal entries for the selected transactions above.

b. Prepare adjusting entries at December 31.

c. Compute the total net liability to be reported on the December 31 balance sheet for:

1. The interest-bearing note.

2. The zero-interest-bearing note.

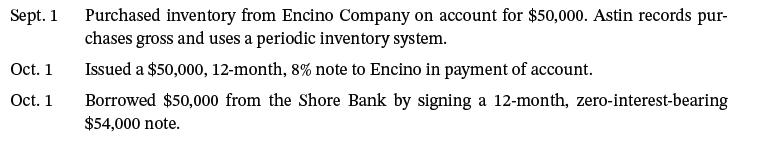

Sept. 1 Oct. 1 Oct. 1 Purchased inventory from Encino Company on account for $50,000. Astin records pur- chases gross and uses a periodic inventory system. Issued a $50,000, 12-month, 8% note to Encino in payment of account. Borrowed $50,000 from the Shore Bank by signing a 12-month, zero-interest-bearing $54,000 note.

Step by Step Answer:

a Sept 1 Accounts Payable Oct 1 Purchases Accounts Payable Notes Payable Cash Oct ...View the full answer

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

The following are selected 2014 transactions of Sean Astin Corporation. Sept. 1 Purchased inventory from Encino Company on account for $50,000. Astin records purchases gross and uses a periodic...

-

The following are selected 2019 transactions of Darby Corporation. Sept. 1 Purchased inventory from Orion Company on account for $50,000. Darby records purchases gross and uses a periodic inventory...

-

The following are selected 2012 transactions of Darby Corporation. Sept. 1 Purchased inventory from Orion Company on account for $50,000. Darby records purchases gross and uses a periodic inventory...

-

A mortgage loan officer uses math on a continual basis during the mortgage lending process. When a prospective borrower applies for a loan, many calculations are made: debt-to-income- ratio,...

-

What is the most important number a firm reports in the opinion of Wall Street analysts? What problems has this created?

-

The average farm in the United States in 2004 contained 443 acres. The standard deviation is 42 acres. Use Chebyshevs theorem to find the minimum percentage of data values that will fall in the range...

-

Using the tables in Figure PG.1 as a source of information: a. Define the implied business rules for the relationships. b. Using your best judgment, choose the type of participation of the entities...

-

On January 1, 2015, Fisher Corporation paid $2,290,000 for 35 percent of the outstanding voting stock of Steel, Inc., and appropriately applies the equity method for its investment. Any excess of...

-

\ table [ [ Transaction , Description of transaction ] , [ 0 1 . June 1 : Lauryn, an investor, made an investment in Byte by purchasing 1 , 8 0 0 shares of its common, ] ] June 1 : Jeremy, an...

-

Record the adjusting entry for supplies remaining on hand at the end of the year equal to $3,900. Record the closing entry for revenue. Record the closing entry for expenses. Record the closing entry...

-

In 2025, Ghostbusters Corp. spent $420,000 for goodwill visits by sales personnel to key customers. The purpose of these visits was to build a solid, friendly relationship for the future and to gain...

-

Czeslaw Corporations research and development department has an idea for a project it believes will culminate in a new product that would be very profitable for the company. Because the project will...

-

Discuss the advantages and disadvantages of grievance mediation.

-

Choose a private label product that you have seen and discuss the possible reasons for why the particular retailer introduced this private label product and explain its features in detail.

-

Understanding your behaviors can help you become a better leader. As discussed in module 4 our beliefs & values can be summed up as our 'personality'. In this assignment you are to examine your own...

-

This week we learned about assessing competition. Watch the video the History of the Cola Wars and answer the following questions. Using the frameworks from the text and the online lesson, why is...

-

Prior to developing your training programs, you must analyze your organizational military needs, identify employee skills gaps based on performance, and have resources available to support training...

-

Describe specifically how your firm's culture lines up with the bullet points listed for that firm . For instance, if you believe your organization's strategy priority is creativity-driven , then...

-

Borges Inc. recently purchased land to use for the construction of its new manufacturing facility and incurred the following costs: purchase price, $125,000; real estate commissions, $9,500;...

-

Describe a job you have had in the past or a job you are very familiar with. Indicate the negative aspects of the job and how it could be improved with current human resource management techniques.

-

Denise Laframboise is the controller at Yeung Pharmaceutical Industries, a public company. She is currently preparing the calculation for basic and diluted earnings per share and the related...

-

An excerpt from the balance sheet of Denomme Limited follows: Notes and Assumptions December 31, 2011 1. Options were granted/written in 2010 that give the holder the right to purchase 50,000 common...

-

Lapardy Limited had net income for the fiscal year ending June 30, 2011, of $16.4 million. There were 2 million common shares outstanding throughout 2011. The average market price of the common...

-

Question 24 Not yet answered Marked out of 1.00 P Flag question Muscat LLC's current assets and current liabilities are OMR 258,000 and OMR 192,000, respectively. In the year 2020, the company earned...

-

Question 24 Miami Company sold merchandise for which it received $710,400, including sales and excise taxes. All of the firms sales are subject to a 6% sales tax but only 50% of sales are subject to...

-

f the IRS intends to close a Taxpayer Assistance Center, they must notify the public at least _____ days in advance of the closure date. 14 30 60 90

Study smarter with the SolutionInn App