A mortgage loan officer uses math on a continual basis during the mortgage lending process. When a prospective borrower applies for a loan, many

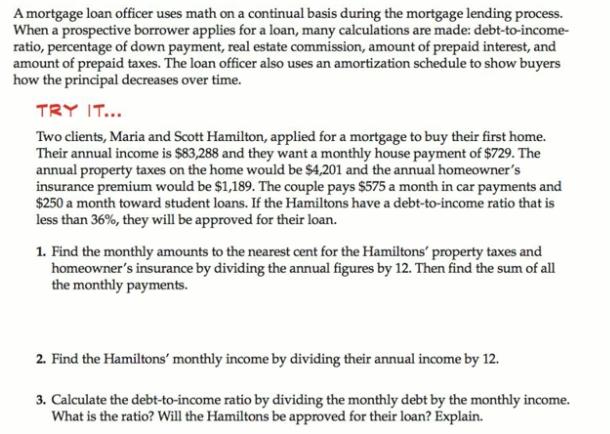

A mortgage loan officer uses math on a continual basis during the mortgage lending process. When a prospective borrower applies for a loan, many calculations are made: debt-to-income- ratio, percentage of down payment, real estate commission, amount of prepaid interest, and amount of prepaid taxes. The loan officer also uses an amortization schedule to show buyers how the principal decreases over time. TRY IT... Two clients, Maria and Scott Hamilton, applied for a mortgage to buy their first home. Their annual income is $83,288 and they want a monthly house payment of $729. The annual property taxes on the home would be $4,201 and the annual homeowner's insurance premium would be $1,189. The couple pays $575 a month in car payments and $250 a month toward student loans. If the Hamiltons have a debt-to-income ratio that is less than 36%, they will be approved for their loan. 1. Find the monthly amounts to the nearest cent for the Hamiltons' property taxes and homeowner's insurance by dividing the annual figures by 12. Then find the sum of all the monthly payments. 2. Find the Hamiltons' monthly income by dividing their annual income by 12. 3. Calculate the debt-to-income ratio by dividing the monthly debt by the monthly income. What is the ratio? Will the Hamiltons be approved for their loan? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Analyzing the Hamiltons DebttoIncome Ratio for Mortgage Approval 1 Monthly ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started