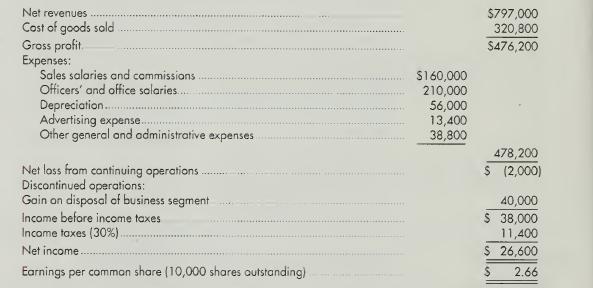

The pre-audit income statement of Jericho Recreation Incorporated was prepared by a newly hired staff accountant for

Question:

The pre-audit income statement of Jericho Recreation Incorporated was prepared by a newly hired staff accountant for the year ending December 31. 2002.

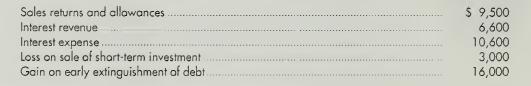

The following information was obtained by Jericho s independent auditor

(a) Net revenues in the income statement included the following items.

(b) Jericho changed its method of inventory- costing in 2002. The staff accountant correctly determined that the cumulative effect of the change, before any tax considerations, was a reduction in current-year income of S 18,000. In preparing the income statement, the accountant added the \($18,000\) to cost of goods sold.

(c) Of the total depreciation expense reported in the income statement. 60"o relates to stores and store equipment, 40% to office building and equipment.

(d) At the beginning of 2002. management decided to close one of Jericho s retail stores. The inventory and equipment were moved to another Jericho store, and the land and building were sold on July 1, 2002, at a pretax gain of \($40,000.\) This amount has been reported under discontinued operations.

(e) The income tax rate is 30%.

Instructions:

Prepare a corrected multiple-step income statement for the year ended December 31, 2002.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780324013078

14th Edition

Authors: Fred Skousen, James Stice, Earl Kay Stice