Tony Akea incorporated his concrete manufacturing operations on January 1, 2002, by issuing 10,000 shares of ($1)

Question:

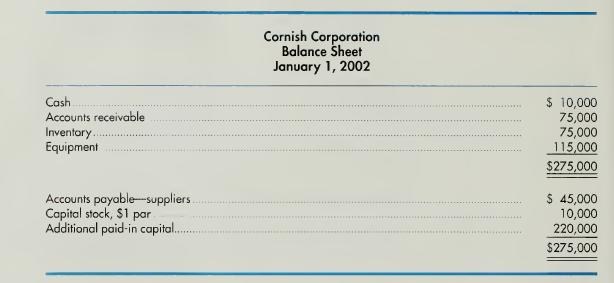

Tony Akea incorporated his concrete manufacturing operations on January 1, 2002, by issuing 10,000 shares of \($1\) par common stock to himself. The following balance sheet for the new corporation was prepared.

During 2002, Cornish Corporation engaged in the following transactions.

(a) Cornish Corporation produced concrete costing \($270,000\). Concrete costs consisted of the following: \($200,000\), raw materials purchased; \($25,000\), labor; and \($45,000\), overhead. Cornish Corporation paid the \($45,000\) owed to suppliers as of January 1 and \($130,000\) of the \($200,000\) of raw materials purchased during the year. All labor, except for \($1,500\), and recorded overhead were paid in cash during the year Other operating expenses of \($15,000\) were incurred and paid in 2002.

(b) Concrete costing \($290,000\) was sold during 2002 for \($380,000\). All sales were made on credit, and collections on receivables were \($365,000\).

(c) Cornish Corporation purchased machinery (fair market value = \($190,000)\) by trading in old equipment costing \($50,000\) and paying \($140,000\) in cash. There is no accumulated depreciation on the old equipment as it was revalued when the new corporation was formed.

(d) Cornish Corporation issued an additional 4,000 shares of common stock for \($25\) per share and declared a dividend of \($3\) per share to all stockholders of record as of December 31, 2002, payable on January 15, 2003.

(e) Depreciation expense for 2002 was \($27,000\). The allowance for doubtful accounts after year-end adjustments is \($2,500\).

Instructions:

Prepare a properly classified balance sheet in account form for the Cornish Corporation as of December 31, 2002.

Step by Step Answer:

Intermediate Accounting

ISBN: 9780324013078

14th Edition

Authors: Fred Skousen, James Stice, Earl Kay Stice