Vorst depreciates Asset A on the double-declining-balance method. How much depreciation expense should Vorst record in 2020

Question:

Vorst depreciates Asset A on the double-declining-balance method. How much depreciation expense should Vorst record in 2020 for Asset A?

a. $32,000

b. $25,600

c. $14,400

d. $6,400

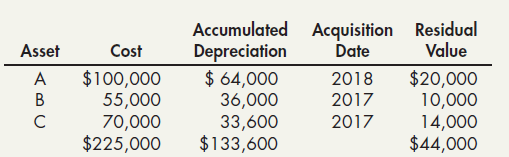

The following information: Vorst Corporation’s schedule of depreciable assets at December 31, 2019, was as follows:

Vorst takes a full year’s depreciation expense in the year of an asset’s acquisition and no depreciation expense in the year of an asset’s disposition. The estimated useful life of each depreciable asset is 5 years.

Accumulated Acquisition Residual Depreciation $ 64,000 Value Asset Cost Date $100,000 55,000 70,000 $225,000 $20,000 10,000 14,000 $44,000 2018 B 36,000 33,600 $133,600 2017 2017

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Multiple Choice Questions 1. A method that excludes residual value from the depreciation base for the calculation of depreciation is: a. Straight- line b. Sum- of- the- years- digits c. Double-...

-

To make some extra money, youve started preparing templates of business forms and schedules for others to download from the Internet (for a small fee). After relevant information is entered into each...

-

The Wine Depot owned the following fixed assets as of December 31, 2018: You are to create Wine Depots fixed asset depreciation summary and individual depreciation worksheets using the straight-line...

-

You are the manager of Fun World, a small amusement park. The accompanying diagram shows the demand curve of a typical customer at Fun World. a. Suppose that the price of each ride is $5. At that...

-

Find the electric field at point B, midway between the upper left and right corners. Two tiny objects with equal charges of 7.00 μC are placed at the two lower corners of a square with...

-

Name at least three kinds of elastomers that are recommended for use when exposed to high-temperature operation.

-

(Earnings Management) Arthur Miller, controller for the Salem Corporation, is preparing the companys income statement at year-end. He notes that the company lost a considerable sum on the sale of...

-

Jerome is an elderly man who lives with his nephew, Philip. Jerome is totally dependent on Philips support. Philip tells Jerome that unless Jerome transfers a tract of land he owns to Philip for a...

-

Kings Department Store is contemplating the purchase of a new machine at a cost of $17,180. The machine will provide $3,300 per year in cash flow for seven years. Kings has a cost of capital of 12...

-

In Part III (Appendix 11B) of the audit case, the audit staff of Adams, Barnes & Co. identified specific revenue risks on working paper RA-12 (page 494). However, the Summary of Audit Approach...

-

Obtain LVMH (Moet Hennessy Louis Vuitton)s 2017 annual report using the Investor Relations portion of its web site (do a Web search for Moet Hennessy Louis Vuitton investor relations). Required: 1....

-

Using the sum-of-the-years-digits method, how much depreciation expense should Vorst record in 2020 for Asset B? a. $6,000 b. $9,000 c. $11,000 d. $12,000 The following information: Vorst...

-

On January 1, 2017, Harrison, Inc., acquired 90 percent of Starr Company in exchange for $1,125,000 fair-value consideration. The total fair value of Starr Company was assessed at $1,200,000....

-

Write a function that takes as input a non-negative integer in the range 0 to 99 and returns the English word(s) for the number as a string. Multiple words should be separated by a space. If the...

-

The Event Manager sighed as the festival approached and she had only five crafts vendors who had committed to taking part in the marketplace. She and her assistant were frantic. They had been...

-

the systematic recording, analysis, and interpretation of costs incurred by a business. Its significance extends beyond mere financial tracking; it plays a pivotal role in aiding management...

-

1.What is your process for ensuring that all your work is correct? 2.What do you mean by Batch Costing ? 3.Explain the accounting procedure for Batch Costing 4.State the applicability of Job Costing...

-

The increasing occurrence of freak weather incidents will have both local and global effects. Even in cases where production has been re-localized, freak weather can still greatly impact local...

-

In Problem write the resulting set using the listing method. {x |x is a month starting with M}

-

Conduct a VRIO analysis by ranking Husson University (in Maine) business school in terms of the following six dimensions relative to the top three rival schools. If you were the dean with a limited...

-

On January 2, 2016, Dekker Company grants each of its 15 new employees 200 restricted share units. Each of the time-vested restricted share units entitles the employee to receive one share of Dekker...

-

The shareholders' equity section of Superior Corporations balance sheet as of December 31, 2015, is as follows: The following events occurred during 2016: Jan. 5 10,000 shares of authorized and...

-

Reconstruct journal Entries At the end of its first year of operations, Leo Company lists the following accounts and ending account balances related to stock transactions and dividends: During the...

-

Question 7 of 7 0/14 W PIERDERY Current Attempt in Progress Your answer is incorrect Buffalo Corporation adopted the dollar value LIFO retail inventory method on January 1, 2019. At that time the...

-

Cost of debt with fees . Kenny Enterprises will issue a bond with a par value of $1,000, a maturity of twenty years, and a coupon rate of 9.9% with semiannual payments, and will use an investment...

-

Assume that an investment of $100,000 is expected to grow during the next year by 8% with SD 20%, and that the return is normally distributed. Whats the 5% VaR for the investment? A. $24,898 B....

Study smarter with the SolutionInn App