Using the sum-of-the-years-digits method, how much depreciation expense should Vorst record in 2020 for Asset B? a.

Question:

Using the sum-of-the-years’-digits method, how much depreciation expense should Vorst record in 2020 for Asset B?

a. $6,000

b. $9,000

c. $11,000

d. $12,000

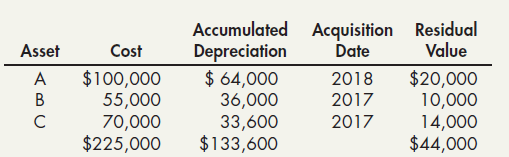

The following information: Vorst Corporation’s schedule of depreciable assets at December 31, 2019, was as follows:

Vorst takes a full year’s depreciation expense in the year of an asset’s acquisition and no depreciation expense in the year of an asset’s disposition. The estimated useful life of each depreciable asset is 5 years.

Accumulated Acquisition Residual Depreciation $ 64,000 Value Asset Cost Date $100,000 55,000 70,000 $225,000 $20,000 10,000 14,000 $44,000 2018 B 36,000 33,600 $133,600 2017 2017

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Vorst depreciates Asset A on the double-declining-balance method. How much depreciation expense should Vorst record in 2020 for Asset A? a. $32,000 b. $25,600 c. $14,400 d. $6,400 The following...

-

(Multiple Choice) 1. A method that excludes residual value from the base for the depreciation calculation is a. Straight-line b. Sum-of-the-years-digits c. Double-declining-balance d....

-

Multiple Choice Questions 1. A method that excludes residual value from the depreciation base for the calculation of depreciation is: a. Straight- line b. Sum- of- the- years- digits c. Double-...

-

Question 1 As at 31 December x5 the statement of financial position of Span and Cat was as follows: Ordinary shares of RM10 each Ordinary shares of RM1 each 7% preference shares of RM1 each 5.6%...

-

Sketch the electric field lines near two isolated and equal (a) Positive point charges and (b) Negative point charges. Include arrowheads to show the field directions.

-

Describe the function of a scraper or wiper on a cylinder rod.

-

(Earnings Management) Grace Inc. has recently reported steadily increasing income. The company reported income of $20,000 in 2001, $25,000 in 2002, and $30,000 in 2003. A number of market analysts...

-

The auditor for ABC Wholesaling Company has just begun to perform analytical procedures as part of planning the audit for the coming year.ABC Wholesaling is in a competitive industry, selling...

-

High Tech Industries (HTI) is producer of biscuits and candies. It is a public company with December 31 year end. Following are the selected portions o HTI trial as of December 1, 2019: Debit Credit...

-

Graph the ATC curves for Plant 1 and Plant 2. Explain why these ATC curves differ. The table shows the production function of Jackie's Canoe Rides. Labor (workers per dayl 10 20 30 40 Canoes Output...

-

Obtain LVMH (Moet Hennessy Louis Vuitton)s 2017 annual report using the Investor Relations portion of its web site (do a Web search for Moet Hennessy Louis Vuitton investor relations). Required: 1....

-

Vorst depreciates Asset C by the straight-line method. On June 30, 2020, Vorst sold Asset C for $28,000 cash. How much gain (loss) should Vorst record in 2020 on the disposal of Asset C? a. $2,800 b....

-

At Toivos auction house in Ishpemming, Michigan, a beautiful stuffed moose head is being sold by auction. There are 5 bidders in attendance: Aino, Erkki, Hannu, Juha, and Matti. The moose head is...

-

Consider: x3 + c (x 1)(x 3)(x + 1) (x + 3x + 9) (x + 2x + 5) How many partial fractions are there in the partial fraction decomposition of this function? How many unknowns (A, B, ...) must be...

-

Hand trace the following program. 1 y 0 2 for x in range (5): y = y + x 4 print ("x",x, "and y =", y) Note: You can shorten the prompts in your hand trace if you want to.

-

Determine the location using physics calculations to solve the problem. Show step by step details for how you solved the problem. I don't need an explanation explaining how to solve the problem. T By...

-

Give a brief explanation about the organization/company i.e., the products or services, number of employees, etc. Do a SWOT chart to help organize your ideas. Refer to resources in the reading for an...

-

How are organization "formal" and "informal" structures impacted in organizational change? Provide some examples. Compare and contrast Lewin's Change Model with Kotter's Change model. (Show how they...

-

In Problem simplify each expression assuming that n is an integer and n 2. ( + 1)! 3! ( 2)!

-

Trade credit from suppliers is a very costly source of funds when discounts are lost. Explain why many firms rely on this source of funds to finance their temporary working capital.

-

The shareholders equity of a corporation may include both preferred stock and common stock. Preferred stock may (1) be convertible into common stock or (2) be issued with warrants attached enabling...

-

What information is contained in a corporation's articles of incorporation?

-

What is the difference between (a) A public and privately held corporation, (b) An open and closed corporation, and (c) A domestic and foreign corporation (as viewed by a particular state)?

-

Simpson Ltd is a small IT company, which has 2 million shares outstanding and a share price of $20 per share. The management of Simpson plans to increase debt and suggests it will generate $3 million...

-

The following are the information of Chun Equipment Company for Year 2 . ( Hint: Some of the items will not appear on either statement, and ending retained earnings must be calculated. ) Salaries...

-

Alta Ski Company's inventory records contained the following information regarding its latest ski model. The company uses a periodic inventory system. Beginning inventory, January 1, 2018 1,250 units...

Study smarter with the SolutionInn App