Vorst depreciates Asset C by the straight-line method. On June 30, 2020, Vorst sold Asset C for

Question:

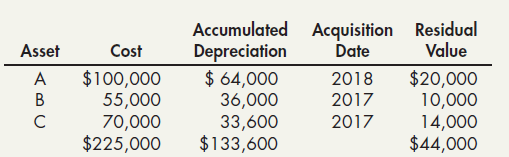

Vorst depreciates Asset C by the straight-line method. On June 30, 2020, Vorst sold Asset C for $28,000 cash. How much gain (loss) should Vorst record in 2020 on the disposal of Asset C?

a. $2,800

b. ($2,800)

c. ($5,600)

d. ($8,400)

The following information: Vorst Corporation’s schedule of depreciable assets at December 31, 2019, was as follows:

Vorst takes a full year’s depreciation expense in the year of an asset’s acquisition and no depreciation expense in the year of an asset’s disposition. The estimated useful life of each depreciable asset is 5 years.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Question Posted: