Assume the same information as in P20.9. Instructions Follow the instructions assuming that McKee Electronics follows IFRS

Question:

Assume the same information as in P20.9.

Instructions

Follow the instructions assuming that McKee Electronics follows IFRS 16.

Data From P20.9.

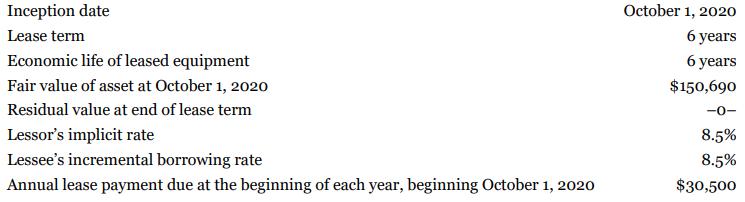

The following facts pertain to a non-cancellable lease agreement between Woodhouse Leasing Corporation and McKee Electronics Ltd., a lessee, for a computer system:

The collectibility of the lease payments is reasonably predictable, and there are no important uncertainties about costs that have not yet been incurred by the lessor. McKee Electronics Ltd., the lessee, assumes responsibility for all repairs and maintenance costs, which amount to $2,500 per year and are to be paid each October 1, beginning October 1, 2020, by the lessee directly to the suppliers. The asset will revert to the lessor at the end of the lease term. The straight-line depreciation method is used for all equipment.

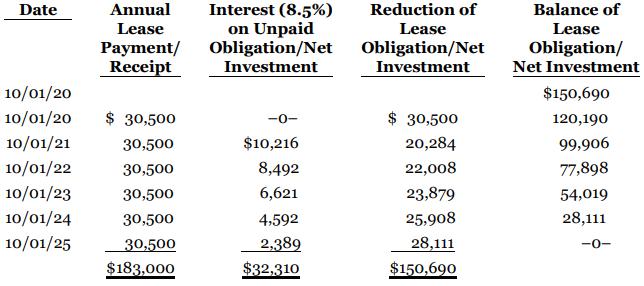

The following amortization schedule for the lease obligation has been prepared correctly for use by both the lessor and the lessee in accounting for this lease using ASPE. The lease is accounted for properly as a capital lease by the lessee and as a direct financing lease by the lessor.

Instructions

Answer the following questions, rounding all numbers to the nearest dollar.

a. Assuming that McKee Electronics’ accounting period ends on September 30, answer the following questions with respect to this lease agreement.

1. What items and amounts will appear on the lessee’s income statement for the year ended September 30, 2021?

2. What items and amounts will appear on the lessee’s balance sheet at September 30, 2021?

3. What items and amounts will appear on the lessee’s income statement for the year ended September 30, 2022?

4. What items and amounts will appear on the lessee’s balance sheet at September 30, 2022?

b. Assuming that McKee Electronics’ accounting period ends on December 31, answer the same questions as in part (a) above for the years ended December 31, 2020 and 2021.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy