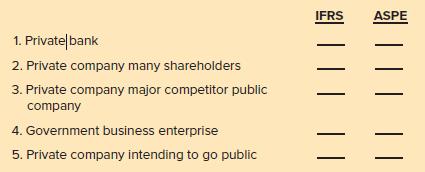

Indicate whether the use of IFRS or ASPE is required or more likely for the following entities:

Question:

Indicate whether the use of IFRS or ASPE is required or more likely for the following entities:

Transcribed Image Text:

IFRS ASPE 1. Privateļbank 2. Private company many shareholders 3. Private company major competitor public company 4. Government business enterprise 5. Private company intending to go public ||| ||

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 68% (16 reviews)

1 Private bank IFRS required since publicly accountable enterprise 2 Private company many sh...View the full answer

Answered By

HILLARY KIYAYI

I am a multi-skilled, reliable & talented Market analysis & Research Writer with a proven ability to produce Scholarly Papers, Reports, Research and Article Writing and much more. My ultimate quality is my English writing/verbal skill. That skill has proven to be the most valuable asset for project writing, Academic & Research writing, Proofreading, HR Management Writing, business, sales, and a variety of other opportunities.

4.80+

24+ Reviews

60+ Question Solved

Related Book For

Intermediate Accounting Volume 1

ISBN: 9781260306743

7th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod Dick

Question Posted:

Students also viewed these Business questions

-

Required a. Consider whether the use of the EVA as the sole performance measure is suitable in the current circumstances? b. Consider whether the introduction of a balanced scorecard could facilitate...

-

Suppose that you want to determine whether the use of one aspirin per day for people age 50 and older reduces the chance of heart attack. You have 200 people available for the study: 100 men and 100...

-

Indicate whether each of the following business entities is more likely to be established as a sole proprietorship (SP), partnership (P), or corporation (C). Provide reasons for your choice. a. A...

-

Susan and Stan Collins live in Iowa, are married and have two children ages 6 and 10. In 2018, Susans income is $38,290 and Stans is $12,000 and both are self-employed. They also have $500 in...

-

This problem can be worked by calculator or with the spreadsheet in Figure 18-5. Consider compounds X and Y in the example labeled "Analysis of a Mixture, Using Equations 18-6" in Section 18-1. Find...

-

Consider Example G1. Think of three additional items for which the manager might want to check to ensure that the data are clean. lop5

-

Wind turbine blade stress. Mechanical engineers at the University of Newcastle (Australia) investigated the use of timber in high-efficiency small wind turbine LO9 blades (Wind Engineering, Jan....

-

On June 1, Noonan Inc. issues 4,000 shares of no-par common stock at a cash price of $6 per share. Journalize the issuance of the shares assuming the stock has a stated value of $1 per share.

-

(d) Calculate the prices and the percentages. Selling Price =$83.00 Markup based on Cost =23% (Do not include the $ in your answer.) Cost = Markup = (Calculate percentages correct to 3 decimal...

-

You are advising a lender group and the debtor FA provides the following summary 13-week cash flow information. Calculate the implied EBITDA for the period Receipts Payroll AP disbursements Rent...

-

Indicate whether the use of IFRS or ASPE is required or more likely for the following entities: IFRS ASPE 1. Bank 2. Private company two shareholders 3. Public company 4. Mutual fund 5. Private...

-

Indicate whether each statement is true or false. If the statement is false, provide a brief explanation of why it is false. 1. A disclosed basis of accounting is GAAP. 2. An audit opinion can be...

-

Find the exact value, if any, of each composite function. If there is no value, say it is not defined. Do not use a calculator. cos(csc -1 (5/3))

-

Sunn Company manufactures a single product that sells for $180 per unit and whose variable costs are $141 per unit. The company's annual fixed costs are $636,000. The sales manager predicts that next...

-

Question 22(5 points) Silver Corp. declares a 15% stock dividend to its shareholders on 1/18. On that date, the company had 15,000 shares issued and 12,000 shares outstanding. Silver Corp. common...

-

Select your a diagnosis from the DSM-5. using your information found through a search of the literature available on your selected diagnosis using appropriate references of peer reviewed journal...

-

Problem 1: Grand Monde Company manufactures various lines of bicycles. Because of the high volume of each type of product, the company employs a process cost system using the FIFO method to determine...

-

Draw the shear force, bending moment diagram of a beam for the loading condition as shown in the figure. Determine the maximum bending moment, and shear force in the beam. Support reactions are pre-...

-

Plot the point whose spherical coordinates are given. Then find the rectangular coordinates of the point. (a) (2, 3/4, /2) (b) (4, /3, /4)

-

A summary of changes in Pen Corporation's Investment in Sam account from January 1, 2011, to December 31, 2013, follows (in thousands): ADDITIONAL INFORMATION 1. Pen acquired its 80 percent interest...

-

Killroy Company owns a trade name that was purchased in an acquisition of McClellan Company. The trade name has a book value of $3,500,000, but according to GAAP, it is assessed for impairment on an...

-

Assume that Best Buy made a December 31 adjusting entry to debit Salaries and Wages Expense and credit Salaries and Wages Payable for $4,200 for one of its departments. On January 2, Best Buy paid...

-

What are the sources of pressure that change and influence the development of GAAP?

-

1,600 Balance Sheet The following is a list (in random order) of KIP International Products Company's December 31, 2019, balance sheet accounts: Additional Paid-In Capital on Preferred Stock $2,000...

-

Question 3 4 pts 9 x + 3 x 9 if x 0 Find a) lim f(x), b) lim, f(x), C), lim , f(x) if they exist. 3 Edit View Insert Format Tools Table : 12pt M Paragraph B IV A2 Tv

-

Mr. Geoffrey Guo had a variety of transactions during the 2019 year. Determine the total taxable capital gains included in Mr. Guo's division B income. The transactions included: 1. On January 1,...

Study smarter with the SolutionInn App