Silver Ridge Plumbings year end is October 31. The companys trial balance prior to adjustments follows: Additional

Question:

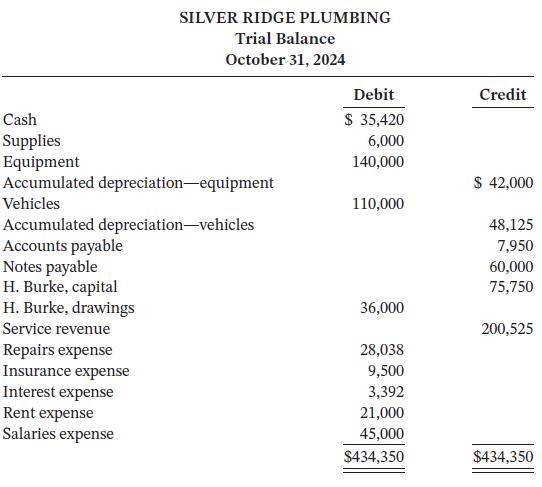

Silver Ridge Plumbing’s year end is October 31. The company’s trial balance prior to adjustments follows:

Additional information:

1. The equipment has an expected useful life of 10 years. The vehicles’ expected useful life is eight years.

2. A physical count showed $2,000 of supplies on hand at October 31, 2024.

3. Accrued salaries payable at October 31, 2024, were $2,550.

4. Interest on the 5.5% note payable is payable at the end of each month and $10,000 of the principal must be paid on December 31 each year. Interest payments are up to date as at September 30, 2024.

5. The owner, H. Burke, invested $2,000 cash in the business on December 28, 2023. (Note: This has been correctly recorded.)

Instructions

a. Prepare the adjusting entries and an adjusted trial balance.

b. Calculate profit or loss for the year.

c. Prepare a statement of owner’s equity and a classified balance sheet.

d. Prepare the closing entries. Using T accounts, post to the Income Summary, Owner’s Drawings, and Owner’s Capital accounts. Compare the ending balance in the Owner’s Capital account with the information in the statement of owner’s equity.

Taking It Further

Why do you need to know the amount the owner invested in the business this year if it has been correctly recorded?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak