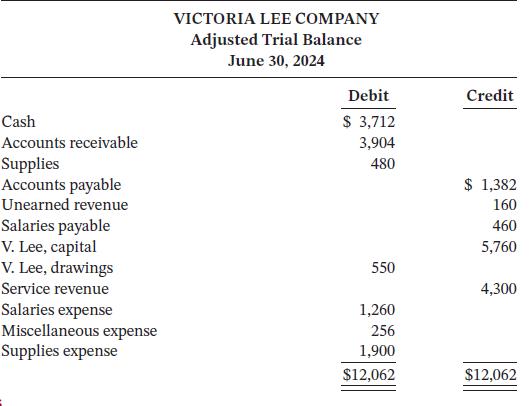

The adjusted trial balance for Victoria Lee Company for the year ended June 30, 2024, follows. Instructions

Question:

The adjusted trial balance for Victoria Lee Company for the year ended June 30, 2024, follows.

Instructions

a. Prepare closing entries at June 30, 2024.

b. Prepare a post-closing trial balance.

Transcribed Image Text:

Cash Accounts receivable Supplies Accounts payable Unearned revenue Salaries payable V. Lee, capital V. Lee, drawings Service revenue Salaries expense Miscellaneous expense Supplies expense VICTORIA LEE COMPANY Adjusted Trial Balance June 30, 2024 Debit $ 3,712 3,904 480 550 1,260 256 1,900 $12,062 Credit $ 1,382 160 460 5,760 4,300 $12,062

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (4 reviews)

a b June 30 Service Revenue Income Summary To close revenue accou...View the full answer

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Question Posted:

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

The adjusted trial balance for Victoria Lee Company for the year ended June 30, 2017, follows. Instructions (a) Prepare closing entries at June 30, 2017. (b) Prepare a post-closing trial balance....

-

The adjusted trial balance for Victoria Lee Company for the year ended June 30, 2021, follows. Instructions a. Prepare closing entries at June 30, 2021. b. Prepare a post-closing trial balance....

-

Victoria Lee Company had the following adjusted trial balance. Instructions a. Prepare closing entries at June 30, 2020. b. Prepare a post-closing trial balance. Victoria Lee Company Adjusted Trial...

-

QUESTION THREE The following is an extract of a trial balance of Ruslan-Ford Partners as at 28 February 2023 Capital: Ruslan Capital: Ford Current account: Ruslan 01/03/2022 Current account: Ford...

-

Use the statements of income for GameStop Corp. to perform a horizontal analysis for each item reported for the year from February 2, 2008, to January 31, 2009. What does your analysis tell you about...

-

A middle-aged man starts to wear eyeglasses with lenses of +2.0 D that allow him to read a book held as close as 25 cm. Several years later, he finds that he must hold a book no closer than 33 cm to...

-

The current air-traffic control systems in the United States are at least 20 years behind the current technologies and without an upgrade the United States is at risk of falling behind the rest of...

-

There are some 200 economic integration agreements in effect around the world already, far more than even a few years ago. Virtually every country is now party to one or more free trade agreements....

-

Blue Spruce Corporation purchased from its stockholders 4.100 shares of its own previously issued stock for $209,100. it later revold 1640 shares for $54 per share then 1.640 more shares for 549 per...

-

1. A saturated sample of soil weighed 138.89g before drying and 112.89 after drying.If the dimensions of the sample were 35mm diameter and 70mm long, calculate: 2. The voids ratio to 3 decimal...

-

Lee Chang opened Lees Window Washing on July 1, 2024. In July, the following transactions were completed: July 1 Lee invested $20,000 cash in the business. 1 Purchased a used truck for $25,000,...

-

Casey Hartwig, CPA, was retained by Global Cable to prepare financial statements for the year ended April 30, 2024. Hartwig accumulated all the ledger balances per Globals records and found the...

-

A man went to Atlantic City with $500 and placed 100 bets of $5 each, one after another, on the same number on the roulette wheel. There are 38 numbers on the wheel and the gaming casino pays 35...

-

Case study: Sun City - improving operations performance to enhance guest experience 1. Describe how Sun City implements the five operations performance objectives or principles. 2. Using your...

-

What recommendations do you have to increase the likelihood of success? E.g., how would you reduce the likelihood of having to go back to A4? How would you reduce the impact of having to go back to...

-

Problem 4 An electrically heated, square plate (0.4mx 0.4 mx0.005 m) is suspended in air of temperature Too = 20C. Find the electrical power needed to maintain the plate at T=95C if the plate is (a)...

-

Number of units Unit Cost Sales Beginning inventory 800 $50 Purchased 600 $52 Sold 400 $80 Sold 350 $90 Ending inventory 650 In the table below, calculate the dollar value for the period for each of...

-

10. Dr. D went to MGM Springfield casino while the class was taking their midterm exam. He played a Konami machine entitled 88 Fortunes. A slot attendant accidently left the slot manual next to the...

-

Nickleby's Ski Store is completing the accounting process for its first year ended December 31, 2014. The transactions during 2014 have been journalized and posted. The following data are available...

-

Select the correct answer for each of the following questions. 1. On December 31, 20X3, Saxe Corporation was merged into Poe Corporation. In the business combination, Poe issued 200,000 shares of its...

-

For the year ended June 30, 2017, Viceron Inc. had service revenue of $800,000 and operating expenses of $575,000. The company has a 15% income tax rate. No income tax installments have been paid or...

-

Refer to the information for Viceron Inc. and your answer in BE13-6. Prepare an income statement for Viceron Inc. for the year ended June 30, 2017. In exercise For the year ended June 30, 2017,...

-

On October 14, the board of directors of Celeria Corp. voted to declare the annual preferred share dividend to shareholders of record on November 1, payable on November 21. The company is authorized...

-

Which of the following statements regarding traditional cost accounting systems is false? a. Products are often over or under cost in traditional cost accounting systems. b. Most traditional cost...

-

Bart is a college student. Since his plan is to get a job immediately after graduation, he determines that he will need about $250,000 in life insurance to provide for his future wife and children...

-

Reporting Financial Statement Effects of Bond Transactions (please show me how you got the answers) Lundholm, Inc., which reports financial statements each December 31, is authorized to issue...

Study smarter with the SolutionInn App