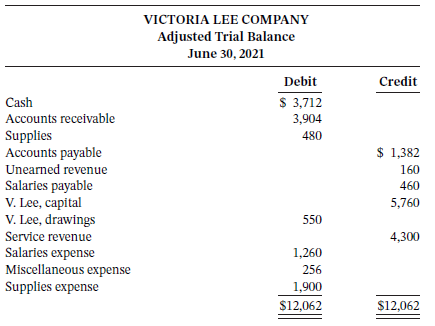

The adjusted trial balance for Victoria Lee Company for the year ended June 30, 2021, follows. Instructions

Question:

The adjusted trial balance for Victoria Lee Company for the year ended June 30, 2021, follows.

Instructions

a. Prepare closing entries at June 30, 2021.

b. Prepare a post-closing trial balance.

Transcribed Image Text:

VICTORIA LEE COMPANY Adjusted Trial Balance June 30, 2021 Debit Credit Cash Accounts receivable $ 3,712 3,904 Supplies Accounts payable Unearned revenue Salaries payable V. Lee, capital V. Lee, drawings 480 $ 1,382 160 460 5,760 550 Service revenue 4,300 Salaries expense Miscellaneous expense Supplies expense 1,260 256 1,900 $12,062 $12,062

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 63% (11 reviews)

a June 30 Service Revenue 4300 Income Summary ...View the full answer

Answered By

Seema kuldeep

although I don't have an experience of teaching in a particular institute, previously I was an expert on Chegg and I have used to teach my batch mates and also my juniors.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Accounting Principles Volume 1

ISBN: 978-1119502425

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Question Posted:

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

The adjusted trial balance for Okabe Company is presented in exercise. In Exercise, Okabe Company ended its fiscal year on July 31, 2017. The companys adjusted trial balance as of the end of its...

-

The adjusted trial balance for Phoebe Company is presented in E4.8. Instructions a. Prepare an income statement and an owners equity statement for the year. Phoebe did not make any capital...

-

The adjusted trial balance for Karr Bowling Alley at December 31, 2011, contains the following accounts. Instructions (a) Prepare a classified balance sheet; assume that $13,900 of the note payable...

-

What is the is the effect of abolition of an import quota on (i) national saving, (ii) domestic investment, (iii) NCO, (iv) the real exchange rate, and (v) net exports?

-

Compute I in Prob. 10.15 using mesh analysis In Problem 10.15 520 A 2 202-90 (+

-

Assume you are a hotel front-office manager who is interviewing an applicant for the position of front-desk clerk. Write one or two behavioral questions, including two or three follow-up, probing...

-

Explain how a user could adjust reported earnings in view of the difference between the balance sheet value of outstanding long-term debt and its market value.

-

The administrators of Crawford Countys Memorial Hospital are interested in identifying the various costs and expenses that are incurred in producing a patients X-ray. A list of such costs and...

-

Help answer 1 a - 1 d ( info behine 1 a ) im looking for the Molding department _ _ _ per MH ? + Fabrication department _ _ _ _ per MH ? Fill in the blank )

-

Palmer, a U.S. company, acquired 90% of Scalas voting stock for $32,600 in cash on January 1, 2019, when Scalas book value was $5,000. The fair value of the noncontrolling interest at the date of...

-

Silver Ridge Plumbing?s year end is October 31. The company?s trial balance prior to adjustments follows: Additional information: 1. The equipment has an expected useful life of 10 years. The...

-

Natalie had a very busy May. At the end of the month, after Natalie has journalized and posted her adjusting and correcting entries, she has prepared an adjusted trial balance. Instructions Using the...

-

Determine the following indefinite integrals. Check your work by differentiation. (5/t 2 + 4t 2 ) dt

-

j. Interest was accrued on the note receivable received on October 17 ($100,000, 90-day, 9% note). Assume 360 days per year. Date Description Dec. 31 Interest Receivable Interest Revenue Debit Credit

-

A Chief Risk Officer (CRO) is interested in understanding how employees can benefit from AI assistants in a way that reduces risk. How do you respond

-

Based on contract law principles, do you think the jury\'s verdict against the Loewen Group for $ 5 0 0 million was appropriate? Why or why not? What factors should the jury have considered in...

-

5.) Consider you have two systems - one filled with (1kg) water and the other with (1kg) of air. Both systems are at 1000 kPa and 30 C. Determine numerically which fluid system has the larger...

-

Question 3: The partnership of Blossom, Blue, and Kingbird engaged you to adjust its accounting records and convert them uniformly to the accrual basis in anticipation of admitting Kerns as a new...

-

Why is the product of molar concentration and volume constant for a dilution problem?

-

Convert the numeral to a HinduArabic numeral. A94 12

-

Two independent situations follow: 1. Longbine Corporation redeemed $130,000 face value, 12% bonds on June 30, 2017, at 102. The bonds' amortized cost at the redemption date was $117,500. The bonds...

-

On January 1, 2017, Chilton Ltd. issued $500,000 of 5%, 5-year bonds. The bonds were issued to yield a market interest rate of 6%. Chilton's year end is December 31. On January 1, 2019, immediately...

-

Cove Resort Corp. issued a 20-year, 7%, $240,000 mortgage note payable to finance the construction of a new building on December 31, 2017. The terms provide for semi-annual instalment payments on...

-

ABC company issued a bond on Jan. 1st, 2018. ABC Company prepared the following amortization schedule for the bond. Date Cash Paid Interest Expense Decrease in Carrying Value Carrying Value 1/1/2018...

-

ohn has an investment opportunity that promises to pay him $16,000 in four years. He could earn a 6% annual return investing his money elsewhere. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1...

-

Explain the difference between upstream and downstream intraentity transfers and how each affects the computation of noncontrolling interest balances.

Study smarter with the SolutionInn App