The following is a pre-closing trial balance for Kalico Kats, as at December 31, 2021: During the

Question:

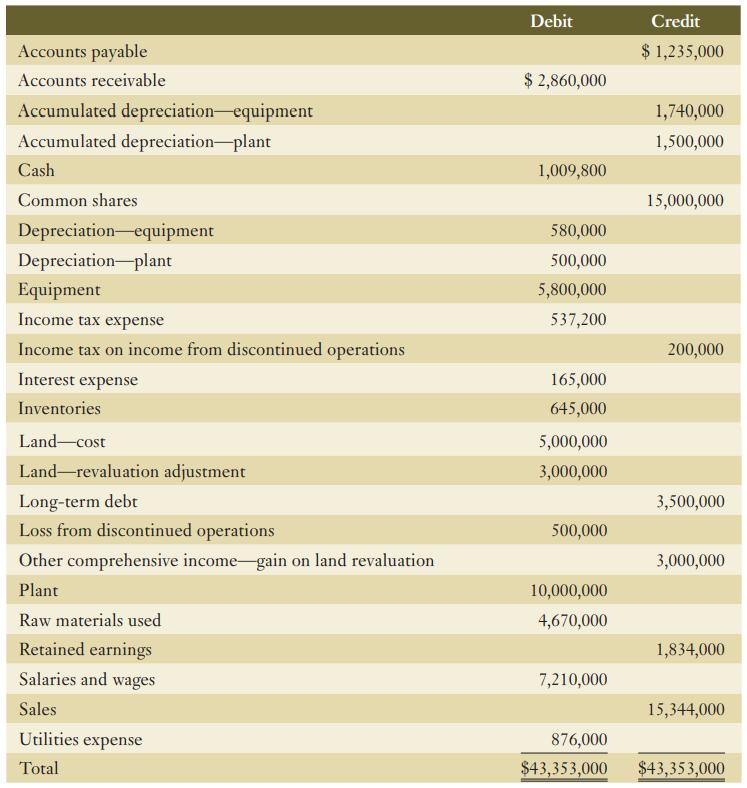

The following is a pre-closing trial balance for Kalico Kats, as at December 31, 2021:

During the year, the company declared and paid $500,000 of dividends and issued shares for proceeds of $5,000,000.

Required:

Prepare, in good form, the following:

a. A statement of comprehensive income that includes net income and comprehensive income in one schedule.

b. A statement of changes in equity.

Accounts payable Accounts receivable Accumulated depreciation equipment Accumulated depreciation-plant Cash Common shares Depreciation equipment Depreciation plant Equipment Income tax expense Income tax on income from discontinued operations Interest expense Inventories Land-cost Land-revaluation adjustment Long-term debt Loss from discontinued operations Other comprehensive income-gain on land revaluation Plant Raw materials used Retained earnings Salaries and wages Sales Utilities expense Total Debit $ 2,860,000 1,009,800 580,000 500,000 5,800,000 537,200 165,000 645,000 5,000,000 3,000,000 500,000 10,000,000 4,670,000 7,210,000 876,000 $43,353,000 Credit $ 1,235,000 1,740,000 1,500,000 15,000,000 200,000 3,500,000 3,000,000 1,834,000 15,344,000 $43,353,000

Step by Step Answer:

a Statement of Comprehensive Income Kalico Kats Statement of Comprehensive Income For the Year Ended ...View the full answer

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Business questions

-

The following is the pre closing trial balance for Allen University as of June 30, 2017. Additional information related to net assets and the statement of cash flows is also provided. Additional...

-

The following is a pre-closing trial balance for Kalico Kats, as at December 31, 2018: During the year, the company declared and paid $500,000 of dividends and issued shares for proceeds of...

-

Prepare in good form an income statement for Franklin Kite Co. Inc. Take your calculations all the way to computing earnings per share. Sales $900,000 Shares outstanding 50,000 Cost of goods sold...

-

Explain these points in detail w.r.t application of control in auditing with examples. 1: Relate data capture control with internal control in auditing with example 2: Relate validation control with...

-

In your words, describe and illustrate the Great Divide. Do you believe the Great Divide phenomenon is as widely experienced as the text indicates? Support your position with an illustration.

-

Chicago Consulting Group, which uses an activity-based costing (ABC) system, offers a softwaretraining seminar to companies for $12,000 per seminar for 100 students; unit-level activities cost $30...

-

What might it mean if a forecasting method has no bias yet has a large MAD? LO.1

-

Last year, Lakeshas Lounge Furniture Corporation had an ROE of 17.5 percent and a dividend payout ratio of 20 percent. What is the sustainable growth rate?

-

Sierra gets a Home mortgage loan for $900,000, as part of her purchase of a new house near GreenLake for $1,000,000. During 2022, she paid a total of $36,000 in interest to the bank on this loan. How...

-

Richards and Willard determined the molar mass of lithium collected the following data. 6 (a) Find the mean molar mass determined by these workers (b) Find the median molar mass (c) Assuming that the...

-

During the audit of Keats Island Brewery for the fiscal year ended June 30, 2022, the auditors identified the following issues: a. The company sells beer for $1 per bottle, plus $0.10 deposit on each...

-

The following is a partial list of accounts and their balances for Davidson Company as at December 31, 2019: Net income for the year was $838,000 and the company declared $400,000 in dividends during...

-

I:16-13 In terms of a corporations incurring liability for the tax, what is the difference between the personal holding company tax and the accumulated earnings tax? Do both taxes require a tax...

-

The following table contains the monthly operating costs of a company. Salary is not included. Determine the variance and standard deviation of the costs. Enero Febrero Marzo Abril Mayo Junio Julio...

-

Becker & Smith, CPAs, performs a financial statement review for BAM Markets ( BAM ) . Caroline, the manager on the job, learns that Don, a member of the review team, violated the independence rules....

-

Presented here are selected transactions for Sheridan Inc. during August of the current year. Sheridan uses a perpetual inventory system. It estimates a return rate of 10%, based on past experience....

-

. Complete both parts (a) and (b) below. ). In1 (a) Let X11, X12, ..., X be a random sample of size n from a population with mean and variance . Let X21, X22,..., X2n2 be a random sample of size n...

-

41. Let S be the cone z = x + y, z 2, oriented with outward unit normal. Use Stokes' theorem to evaluate the flux integral for the vector field SJ (V x F). ndS F(x, y, z) = (x y)i + 2zj + xk. -

-

The annual worth for years 1 through 8 of the cash flows shown is $30,000. What is the amount of x, the cash flow in year 3, at i = 10% per year? Solve using (a) Tabulated factors, and (b) A...

-

The National Collegiate Athletic Association (NCAA) and the National Federation of State High School Associations (NFHS) set a new standard for non-wood baseball bats. Their goal was to ensure that...

-

The IFRS Framework, paragraph 22, states: In order to meet their objectives, financial statements are prepared on the accrual basis of accounting. Under this basis, the effects of transactions and...

-

In finance, the calculation of net present value s involves cash flows rather than accrual accounting numbers. Indeed, one often takes accounting reports and adjusts for noncash items such as...

-

The accrual basis of accounting implicitly assumes that the firm will continue to operate well into the future such that the result of incomplete transactions will be completed or concluded. This...

-

5. Which of the following is the cheapest for a borrower? a. 6.7% annual money market basis b. 6.7% semi-annual money market basis c. 6.7% annual bond basis d. 6.7% semi-annual bond basis.

-

Waterloo Industries pays 30 percent corporate income taxes, and its after-tax MARR is 24 percent. A project has a before-tax IRR of 26 percent. Should the project be approved? What would your...

-

Imagine you are an Investor in the Stock Market. Identify three companies in the Korean Stock Market (KOSPI) where you would like to invest. Explain your answer

Study smarter with the SolutionInn App