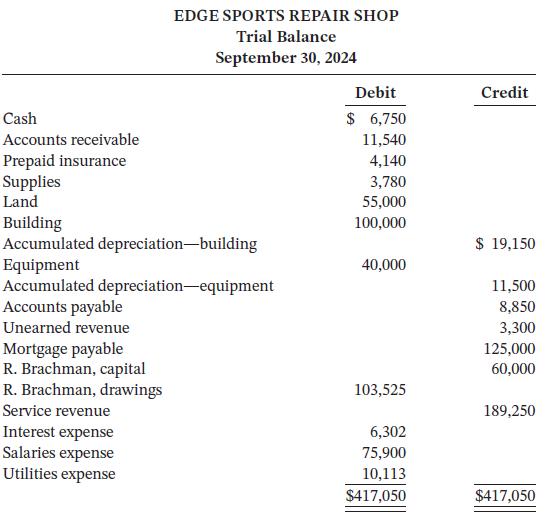

The following is Edge Sports Repair Shops trial balance at September 30, 2024, the companys fiscal year

Question:

The following is Edge Sports Repair Shop’s trial balance at September 30, 2024, the company’s fiscal year end:

Additional information:

1. Services of $5,350 were provided but not recorded at September 30, 2024.

2. The 12-month insurance policy was purchased on February 1, 2024.

3. A physical count of supplies shows $560 on hand on September 30, 2024.

4. The building has an estimated useful life of 50 years. The equipment has an estimated useful life of eight years.

5. Salaries of $1,975 are accrued and unpaid at September 30, 2024.

6. The mortgage payable has a 4.5% interest rate. Interest is paid on the first day of each month for the previous month’s interest.

7. On September 30, 2024, one-quarter of the unearned revenue was still unearned.

8. During the next fiscal year, $5,400 of the mortgage payable is to be paid.

Instructions

a. Prepare the adjusting entries.

b. Prepare an adjusted trial balance.

c. Prepare an income statement, statement of owner’s equity, and classified balance sheet. The owner, Ralph Brachman, invested $4,000 cash in the business on November 21, 2023. The investment has been recorded and it is included in the capital account.

d. Prepare the closing entries.

Taking It Further

Ralph Brachman is concerned because he had to invest $4,000 cash in the business this year. Based on the information in the financial statements, what are your recommendations to Ralph?

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 9781119786818

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak