The income statements of Dwayne Corporation show the following amounts: Using vertical (common-size) analysis, analyze Dwayne Corporation's

Question:

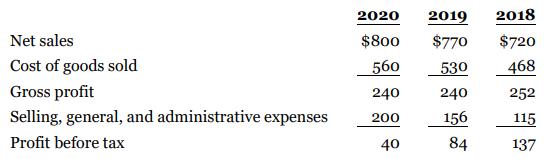

The income statements of Dwayne Corporation show the following amounts:

Using vertical (common-size) analysis, analyze Dwayne Corporation's declining profit before tax. Round answers to zero decimal places.

Transcribed Image Text:

2020 2019 2018 Net sales $800 $770 $720 Cost of goods sold 560 530 468 Gross profit 240 240 252 Selling, general, and administrative expenses 156 200 115 Profit before tax 40 84 137

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 92% (13 reviews)

Percentage commonsize vertical analysis is as follows 2020 2019 2...View the full answer

Answered By

Joemar Canciller

I teach mathematics to students because I love to share what I have in this field.

I also want to see the students to love math and be fearless in this field.

I've been tutoring these past 2 years and I would like to continue what I've been doing.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy

Question Posted:

Students also viewed these Business questions

-

The income statements of Pop Corporation and its 80 percent-owned subsidiary, Son Corporation, for 2016 are as follows: Pop had 10,000 shares of common stock and 1,200 shares of $100 par, 10 percent...

-

The following data are from the income statements of Davros Company. (a) Compute for each year (1) the inventory turnover and (2) the average days to sell the inventory.(b) What conclusions...

-

The following data are from the income statements of Haskin Company. (a) Calculate for each year (1) the inventory turnover and (2) the days sales in inventory. (b) What conclusions concerning the...

-

For each of the following, indicate whether the item would be reported on the balance sheet (B/S), reported on the income statement (I/S), or not shown in the financial statements (Not) and whether...

-

Chlorine dioxide gas (ClO2) is used as a commercial bleaching agent. It bleaches materials by oxidizing them. In the course of these reactions, the ClO2 is itself reduced. (a) What is the Lewis...

-

How often should comparison of actual results with the flexible budget be made? Why? LO.1

-

A right to know? Some people think that the law should require that all political poll results be made public. Otherwise, the possessors of poll results can use the information to their own...

-

Rescue Sequences, LLC, purchased inventory by issuing a $12,000, 10%, 60-day note on October 1. Prepare the journal entries for Rescue Sequences to record the purchase and payment assuming it uses a...

-

urrently, Meyers Manufacturing Enterprises (MME) has a capital structure consisting of 35% debt and 65% equity. MME's debt currently has a 6.8% yield to maturity. The risk-free rate (rRF) is 4.8%,...

-

Which carbocation in each of the following pairs is more stable? a. b. c. d. e. CH3OH2 or CH3NHCH2 + or or CHCH3 CHCH3 or OCH

-

The new auditor's report required under Canadian Auditing Standards highlights key audit matters. What does information on key audit matters provide to potential investors, and how do these matters...

-

Yuen Corporation shows the following financial position and results for the three years ended December 31, 2022, 2021, and 2020 (in thousands): Calculate the current ratio, quick ratio for each year,...

-

Each of Problems 15 through 18 gives the parameters for a forced mass-spring-dashpot system with equation mx" + cx' + kx = F 0 cos t. Investigate the possibility of practical resonance of this...

-

Stefney Christian Date: 06/26/2023 To: From: New England Patriot Subject: Analysis of Aircraft Purchase vs. Chartering Decision I've done a thorough analysis of the decision to buy or charter a plane...

-

The Giovonis' monthly income is $9000. The have 14 remaining payments of $269 on a new car and 16 payments of $70 remaining on their living room furniture. The taxes and insurance on the house are...

-

2. Determine the following inverse z-transforms using partial fraction expansion method. a. The sequence is right sided (causal). 1 z 14z 2 + 4z-3 X(z) = 11 1 Z-1 13 + 2-2 8 1 -3 4Z b. The sequence...

-

(4 pts) 1. Find all vertical and horizontal asymptotes of the function f(x) (You do NOT need to show the limit work) 2x2-2 x+4x+3

-

Cherboneau Novelties produces drink coasters (among many other products). During the current year (year 0), the company sold 532,000 units (packages of 6 coasters). In the coming year (year 1), the...

-

Determine each dealerships apportionment using Adams method. (Some divisors between 91 and 92 will work.) When appropriate round quotas to the nearest hundredth. A boat manufacturer has 120 new boats...

-

Complete problem P10-21 using ASPE. Data from P10-21 Original cost ................................................................. $7,000,000 Accumulated depreciation...

-

Simone Corp. was incorporated on January 1, 2020. For the year ended December 31, 2020, Simone Corp.s taxable income was $105,000. There were no temporary differences. Income tax paid was $31,500....

-

During its first year of operations, Kinkle Corporation reported the following information: Income before income taxes for the year was $450,000 and the tax rate was 30%. Depreciation expense was...

-

CCA = capital cost allowance Taxable income in the two years prior to 2016 was $0. At the beginning of 2016, the company had a deferred income tax liability of $160,000, which relates to property,...

-

crane Inc. common chairs currently sell for $30 each. The firms management believes that it's share should really sell for $54 each. If the firm just paid an annual dividend of two dollars per share...

-

Determine the simple interest earned on $10,000 after 10 years if the APR is 15%

-

give me an example of 10 transactions from daily routine that we buy and put for me Liabilities + Owners' Equity + Revenues - Expenses

Study smarter with the SolutionInn App