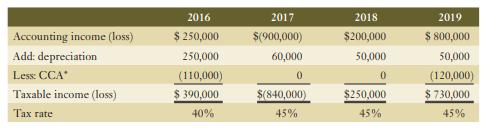

CCA = capital cost allowance Taxable income in the two years prior to 2016 was $0. At

Question:

CCA = capital cost allowance

Taxable income in the two years prior to 2016 was $0. At the beginning of 2016, the company had a deferred income tax liability of $160,000, which relates to property, plant, and equipment whose carrying value of $1,500,000 exceeded its undepreciated capital cost of $1,100,000.

Required:

a. Case A: Prepare the income tax journal entries for the four years, assuming that it is probable the company will realize the benefits of tax losses carried forward.

b. Case B: Prepare the income tax journal entries for the four years, assuming that it is not probable the company will realize the benefits of tax losses carried forward.

c. For both Cases A and B, prepare income statement excerpts including line items between income before tax and net income.

d. Compute the effective tax rate (total tax expense or recovery ÷ income before tax) for each year for both Cases A and B. Comment on any differences or patterns in the effective tax rates.

Step by Step Answer: