The owner of Aurora Inc., Cindy Hickey, has come to you, a public accountant, for advice. I

Question:

The owner of Aurora Inc., Cindy Hickey, has come to you, a public accountant, for advice. “I am very worried about my business right now. My bank loan is at its maximum level, we have no cash, and my salary is backing up, unpaid. I don’t know what has gone wrong, and what I can do about it. Please provide some advice!”

Hickey’s company, Aurora, manufactures and distributes small, specialized boating items that have a good reputation and a stable market among pleasure boaters and fishers. She has been in business for ten years. Cindy reports, “The company showed a profit again this year. I hired a new part-time manager during the year so I could spend less day-to-day time on the operation. He has been building up our asset base. We sold some investments, but made no new ones. We replaced some inefficient machinery, and purchased a vehicle to save on rental expenses.

“We sold old machinery that would not be able to meet the demand that our new manager is projecting. It had a cost of $9,600, and net book value of $3,800. I think the amount I took out of the company was in line with that of previous years, although my salary is backing up, unpaid. I can’t afford that, I can tell you, but the company has no money to pay me.

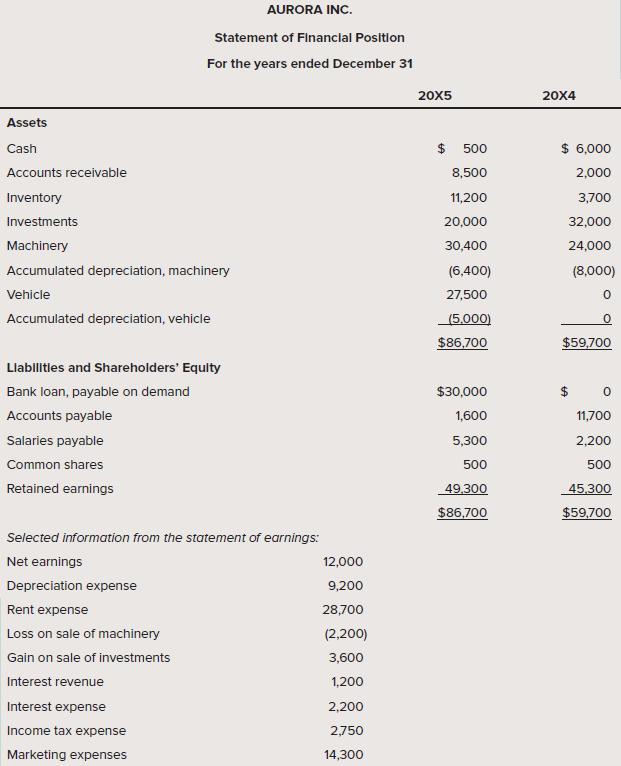

“Our cash has dropped and we now owe a lot on a demand bank loan. I have some financial information for the year (Exhibit 1).”

“Can you explain what is happening with our cash flows? What should I do to get out of this hole?”

Required:

Respond to Cindy’s request.

Step by Step Answer:

Intermediate Accounting Volume 1

ISBN: 9781260306743

7th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod Dick