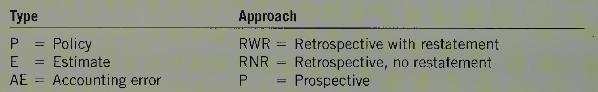

Analyze each case and choose a letter code under each category (type and approach) to indicate the

Question:

Analyze each case and choose a letter code under each category (type and approach) to indicate the preferable accounting for each case.

a. Changed the expected useful lives of depreciable assets from 15 years to 10 years to conform with industry practice.

b. Discovered that a capital asset with a 10 -year life had been expensed when acquired 5 years ago.

c. Began calculating EPS in a different manner because of a change in accounting standards.

d. Changed from straight-line to accelerated depreciation to reflect the company's changing technological environment.

e. Changed the percentage of bad debts accrued from \(1 \%\) of credit sales to \(3 \%\) of credit sales.

f. Recognized an impairment of \(\$ 1.5\) million in a capital asset group. An impairment of \(\$ 1.0\) million became apparent two years previously, but had not been recorded until this year.

g. Switched from FIFO to average cost to conform to parent company preferences. Only opening balances for the current year can be reconstructed.

h. Used the instalment sales method in the past five years; an internal audit revealed that use of this method was intended to delay revenue recognition even though the customers were highly credit-worthy.

i. Began capitalizing development costs because criteria for deferral were met this year for the first time; in the past, future markets had been too uncertain to justify capitalization.

j. Changed inventory cost method to exclude warehousing costs, as required by IFRS.

Step by Step Answer: