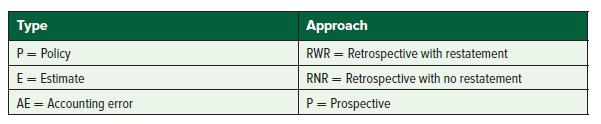

Analyze each case and choose a letter code under each category (type and approach) to indicate the

Question:

Analyze each case and choose a letter code under each category (type and approach) to indicate the preferable accounting for each case.

a. Used the instalment sales method in the past five years; an internal audit revealed that use of this method was intended to delay revenue recognition, even though the customers were highly creditworthy.

b. Incorrectly applied a 20% declining balance rate to equipment acquired three years previously when management had instructed that a 15% rate be used.

c. Changed the method of estimating bad debts accrued from a percentage-of-sales to an aging methodology.

d. Changed inventory cost method to exclude warehousing costs, as required by IFRS.

e. Discovered that a contract with a supplier had become an onerous contract in the previous year but the company had not recognized any associated loss.

f. Recognized an impairment of $1.5 million in a capital asset group. An impairment of $1 million became apparent two years previously but had not been recorded until this year.

g. Began capitalizing development costs because criteria for deferral were met this year for the first time; in the past, future markets had been too uncertain to justify capitalization.

h. Changed the depreciation method for delivery vehicles from straight-line to declining balance to comply with industry norms.

i. Changed from straight-line to accelerated depreciation to reflect the company’s changing technological environment.

j. Switched from FIFO to average cost for inventory to conform to parent company preferences. Opening balances for the current and previous two years can be reconstructed.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781260881240

8th Edition

Authors: Thomas H. Beechy, Joan E. Conrod, Elizabeth Farrell, Ingrid McLeod-Dick, Kayla Tomulka, Romi-Lee Sevel